June 2024 Portfolio Update

Introduction:

- Portfolio Strategy Reminder: This strategy focuses on a disciplined investment approach, starting with a $1 daily investment into dividend-paying stocks, initially focusing on Apple Inc. This incremental investment is designed to steadily build a portfolio that emphasizes both growth and income.

- Goals Overview: The main objectives include capital appreciation and generating a steady income stream through dividends. The strategy utilizes the compounding effect of reinvested dividends to amplify returns over time.

This Month’s Activity:

- Investment Summary: Starting June 3rd, $1 will be invested daily into the HFBL Portfolio, with the first purchase being Apple Inc. This approach will add a total of $30 to the investment over the course of the month.

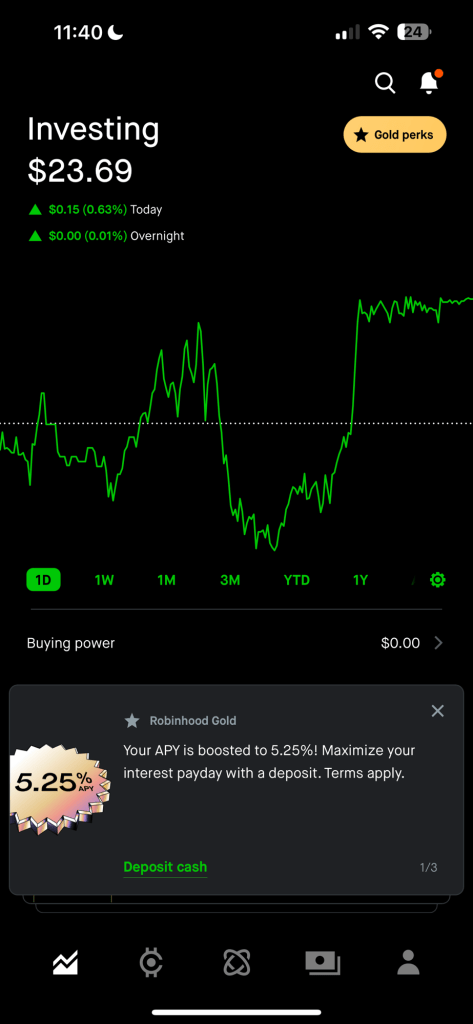

- Current Portfolio Value: The portfolio begins with a value of $23.69, as indicated by the mobile trading app screenshot. This value reflects the initial funding and will change with market dynamics and subsequent investments.

Stock Performance and Market Activity:

- Market Trends: Apple’s stock will be monitored closely in relation to broader market conditions. As a significant entity in the tech sector, its performance is influenced by various factors, including market trends, earnings reports, and economic indicators.

- Dividend Insights: Although dividends are not expected in the immediate first month, Apple is known for its consistent quarterly dividends. The focus will increasingly shift towards dividend tracking and reinvestment as the portfolio matures.

Financial Transactions and Balance Details:

- Buying Power: The screenshot shows a buying power of $0.00, suggesting that initial funds are fully allocated.

- Account Movements: The account has shown a small gain of $0.15 today, indicating active engagement with the market and typical fluctuations within investment accounts.

Learning and Challenges:

- Initial Observations: Even with a modest starting balance, fluctuations in stock prices can significantly influence the visible portfolio value. Establishing a routine of consistent daily investments is the priority at this stage.

- Market Conditions: Deciphering how external factors such as economic news or tech sector developments impact stock prices will be crucial for refining next months investment decisions.

Next Steps:

- Continued Investment in Apple: The plan is to maintain the daily $1 investment in Apple stock, closely watching its performance and broader market conditions to inform any strategy adjustments.

- Exploration of Additional Opportunities: As the portfolio develops and market conditions evolve, diversifying into other dividend-paying stocks may be considered in upcoming updates.

Conclusion:

- Reflection: The initial month sets the groundwork for disciplined, long-term investing. While financial changes may appear minimal initially, the strategy is aimed at building substantial future gains.

- Encouragement: Persistence and consistency will be key, as the real benefits of this strategy—capital growth and dividend income—will become more apparent and impactful over time.