D.9 | (MA) A Deep Dive into Mastercard: Payment Processing and Dividend Growth Potential

Part 1: Company Overview and Philosophy

- Introduction

- Founding and Early History

- Cultural and Ethical Values

- Leadership Philosophy and Style

- Innovation and Adaptability

- Strategic Decision-Making

- Human Capital and Management

- Market Position and Competitive Landscape

- Risks and Mitigation Strategies

Part 2: Dividend Philosophy and Sustainability

- Dividend Tradition and Philosophy

- Dividend Consistency and Culture

- Impact of Corporate Decisions on Dividends

- Stakeholder Value Creation

- Financial Prudence and Allocation

- Economic Moats and Dividend Safety

- Corporate Governance and Dividend Policy

- Long-Term Vision and Dividend Growth

- Qualitative Insights and Future Outlook

Part 1: Company Overview and Philosophy:

Introduction

Mastercard Incorporated (NYSE: MA) is a global technology company in the payments industry, facilitating electronic payments across more than 200 countries and territories. While not a traditional “discount retailer” or manufacturing giant, Mastercard’s business model hinges on processing transactions for financial institutions, merchants, and consumers—charging fees on every swipe, tap, or online payment.

For dividend-focused investors, Mastercard is known for steady dividend growth rather than a high yield. The company’s foundation is built on:

1. Network Scale: Enabling billions of cardholder transactions each year.

2. Brand Strength: A recognized name synonymous with trust and global acceptance.

3. Innovation in Payment Tech: Contactless solutions, mobile wallets, and data analytics.

As the world shifts from cash to digital payments, Mastercard stands at the intersection of finance and technology, capturing fees on transactions ranging from everyday groceries to international travel bookings. However, it also faces fierce competition from Visa (V), American Express (AXP), PayPal (PYPL), and fintech disruptors.

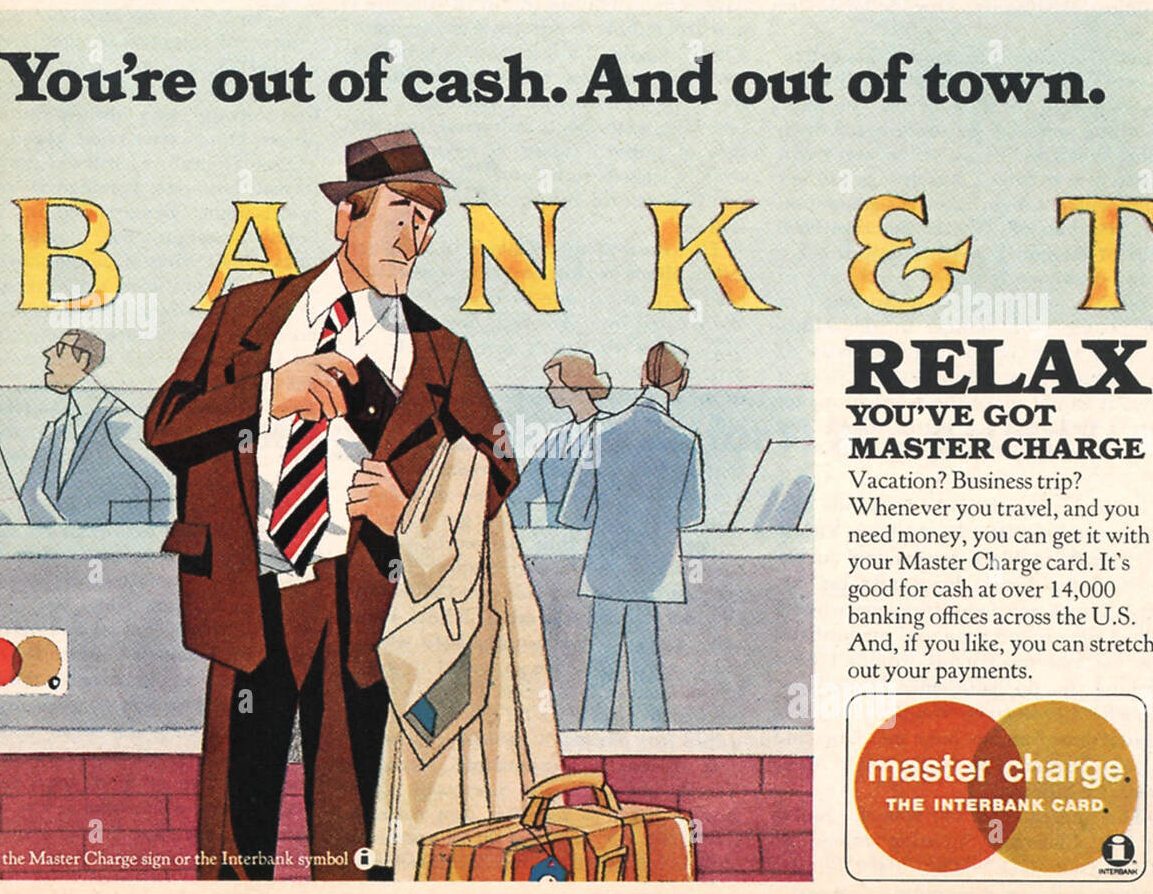

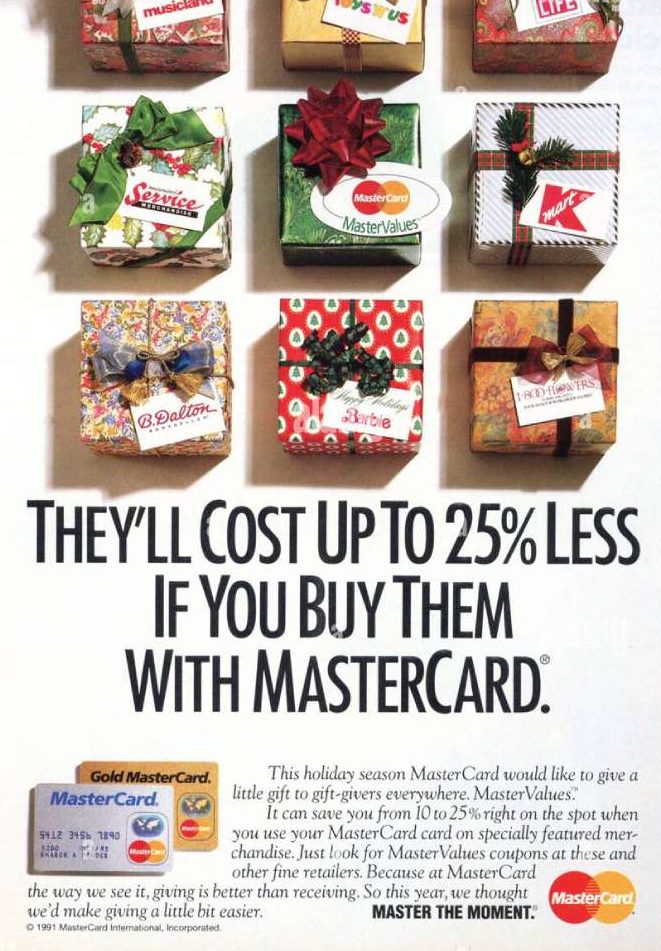

Founding and Early History

Mastercard’s roots trace back to 1966, when a group of California banks formed the Interbank Card Association (ICA) to compete with Bank of America’s BankAmericard (now Visa). The “Master Charge” brand was introduced in the late 1960s, later rebranded as Mastercard in 1979. Over the following decades, Mastercard expanded internationally through partnerships and acquisitions, evolving into a global payments network.

• Early Growth: In the 1970s and 1980s, Mastercard and Visa led the shift from paper-based credit transactions to magnetic stripe cards, streamlining the payment process.

• Global Expansion: By the 1990s, Mastercard had a presence in major world markets, forming alliances with international banks.

• Public Listing: Mastercard went public in 2006 (NYSE: MA), raising capital to fund technology upgrades and global reach.

This evolution from a U.S.-centric association of banks to a publicly traded, multinational payment network provides a sturdy foundation for shareholders seeking reliable growth.

Cultural and Ethical Values

Mastercard’s corporate culture centers on innovation, security, and financial inclusion—aiming to bring electronic payments to underbanked regions. Many of its initiatives focus on:

1. Security and Trust: Ensuring every transaction is secure.

2. Inclusion and Accessibility: Partnerships with governments and NGOs to expand digital payment infrastructure.

3. Employee Development: Investing in a tech-forward workforce capable of building data analytics, AI, and cyber-security solutions.

As a high-profile global brand, Mastercard must maintain strict compliance with data privacy and regulatory requirements. A reputational slip—such as a data breach—could erode consumer and merchant confidence, impacting transaction volumes and, by extension, investor returns.

Leadership Philosophy and Style

Mastercard’s leadership emphasizes:

1. Technology Investments: Funding R&D to stay at the cutting edge of payment innovation, from contactless payments to advanced fraud detection.

2. Strategic Acquisitions: Acquiring smaller payment-tech firms to bolster its platform or break into new regions (e.g., Vocalink in the UK).

3. Partnerships and Collaborations: Partnering with banks, e-wallet providers, retailers, and even rival fintechs to broaden acceptance.

Think of executives regularly reviewing global transaction data, identifying emerging markets with high mobile adoption but limited card infrastructure. Each partnership or new technology rollout must reinforce Mastercard’s brand promise: fast, secure, and universally accepted payments.

Innovation and Adaptability

While Mastercard’s business model may seem straightforward—charging fees per transaction—its growth is fueled by constant innovation:

• Contactless & Mobile: Tap-to-pay and mobile wallet integrations (Apple Pay, Google Pay) to streamline everyday transactions.

• Analytics & Cybersecurity: Value-added services that leverage big data for fraud detection, loyalty programs, and marketing insights.

• Fintech Partnerships: Embracing emerging digital banking platforms, which often rely on Mastercard’s rails for debit card issuance.

Visualize a consumer scanning a smartphone at a metro turnstile or checking out via a “Buy Now” button in an e-commerce cart. Behind these frictionless payments is Mastercard’s network, collecting a small fee. This technology-forward stance keeps Mastercard relevant amidst continuous disruption.

Strategic Decision-Making

Key strategic areas for Mastercard include:

1. Emerging Markets Penetration: Regions like Asia, Africa, and Latin America still have a high proportion of cash transactions—presenting sizable growth potential.

2. Digital Payment Ecosystem: Expanding beyond plastic cards into B2B payments, digital identity verification, and blockchain applications.

3. Regulatory Compliance: Navigating local regulations on interchange fees and consumer protection while maintaining service quality.

Picture executives evaluating quarterly data on the “cash to card” conversion rate in Brazil or India—key metrics for forecasting transaction volume growth and potential new revenue streams. Dividend investors benefit if these strategic moves translate into consistently rising free cash flow.

Human Capital and Management

Mastercard’s workforce includes software engineers, cybersecurity specialists, marketing teams, and compliance experts. Talent retention and recruitment are ongoing priorities, given the competitive market for tech-savvy professionals. An engaged, innovative workforce underpins Mastercard’s R&D and ensures operational reliability.

Think of newly onboarded engineers refining algorithms to spot fraudulent transactions in real time. Each improvement reduces losses for merchants and cardholders, strengthening Mastercard’s position with banking partners. For dividend investors, stable operations and minimal reputational risk are crucial to sustaining long-term profitability.

Market Position and Competitive Landscape

Mastercard is second only to Visa in global card payment volume, also competing with:

• American Express (AXP): Focused on premium cardholders, often issuing cards directly.

• Discover (DFS): A U.S.-focused network with direct issuing.

• PayPal/Venmo (PYPL): Dominant in online and peer-to-peer transactions.

• Fintech Startups (e.g., Block/Square): Payment gateways, mobile POS, and P2P solutions.

Mastercard differentiates itself through wide acceptance, rapid transaction processing, security features, and partnerships with thousands of financial institutions worldwide. However, ongoing competition and regulatory pressure on interchange fees can influence revenue growth and margins.

Risks and Mitigation Strategies

Key risks for Mastercard include:

1. Regulatory Intervention: Governments capping interchange fees or imposing new payment regulations.

2. Cybersecurity Threats: Hackers and fraudsters continually target financial networks.

3. Technological Disruption: Emerging blockchain or digital currencies could bypass conventional card networks.

4. Economic Cycles: Reduced consumer spending in downturns leads to lower transaction volume.

Mastercard mitigates these via proactive engagement with regulators, hefty cybersecurity investments, and gradual experimentation with blockchain-based or real-time payment solutions. Nonetheless, the company must remain agile to maintain its edge in a rapidly shifting payments landscape.

Part 2: Dividend Philosophy and Sustainability:

Dividend Tradition and Philosophy

Mastercard initiated a small dividend in the mid-2000s following its IPO. Though the yield remains low (typically 0.5%–0.8%), Mastercard consistently increases its payout. Below is a hypothetical snapshot of MA’s annualized dividend growth (approximate for illustration):

• 2015: $0.16 per quarter (annual $0.64)

• 2016: $0.19 per quarter (annual $0.76)

• 2017: $0.22 per quarter (annual $0.88)

• 2018: $0.25 per quarter (annual $1.00)

• 2019: $0.33 per quarter (annual $1.32)

• 2020: $0.40 per quarter (annual $1.60)

• 2021: $0.44 per quarter (annual $1.76)

• 2022: $0.49 per quarter (annual $1.96)

• 2023: $0.57 per quarter (annual $2.28)

• 2024: $0.64 per quarter (annual $2.56)

Despite the modest yield, the growth rate of these dividends has been robust—often exceeding 20% annually in earlier years—making Mastercard an appealing long-term compounder.

Dividend Consistency and Culture

Historical Performance: ROE and FCF Payout Ratios

• Return on Equity (ROE): Mastercard typically posts high ROE (30%–50%), reflecting its asset-light model (it doesn’t fund the credit itself; it processes transactions).

• Free Cash Flow (FCF): Strong operating margins (50%+ in some years) and minimal capital expenditure needs result in high FCF conversion. Mastercard’s FCF payout ratio for dividends generally hovers below 30%, leaving ample room for buybacks and growth investments.

Impact of Corporate Decisions on Dividends

Stakeholder Value Creation

Economic Moats and Dividend Safety

Economic Moat Analysis

Mastercard’s moat hinges on:

1. Global Acceptance Network: Millions of merchants accept its branded cards.

2. Trusted Brand: An essential link between consumers, banks, and merchants worldwide.

3. Scale and Partnerships: Operating in over 200 countries, forging deep relationships with financial institutions.

While new payment competitors enter the market, scaling a global network to rival Mastercard’s acceptance and brand trust is no small feat. Network effects help ensure Mastercard’s place at checkout counters remains secure.

Financial Prudence and Allocation

Assessing MA as a Ben Graham or Warren Buffett Investment

• Ben Graham Perspective: MA’s shares often trade at higher multiples (P/E, price-to-book), which might deter strict Graham-style “deep value” hunters. However, its consistent earnings growth and fortress balance sheet could still attract value-conscious investors if there’s a market correction.

• Warren Buffett Perspective: Buffett values businesses with high returns on capital, durable competitive advantages, and reliable management. Mastercard’s brand, extensive network, and efficient business model check these boxes. He also appreciates robust free cash flow generating capacity—which Mastercard has in spades.

While Graham might find the valuation steep, Buffett’s love of high-quality, wide-moat businesses could make MA a likely candidate if bought at a fair price.

Corporate Governance and Dividend Policy

Free Cash Flow Allocation and Capital Discipline

Mastercard prioritizes:

1. Share Repurchases: Often overshadowing its dividend in terms of capital returned to shareholders.

2. Dividend Increases: A modest but consistently rising payout.

3. Strategic Acquisitions and R&D: Building new capabilities (e.g., real-time payments, fraud prevention) and expanding into new regions.

4. Maintaining a Prudent Balance Sheet: Low debt relative to cash flow, ensuring resilience in economic downturns.

This balanced approach helps Mastercard weather cyclical consumer spending shifts and preserve its ability to invest in emerging payment technologies.

Long-Term Vision and Dividend Growth Potential

Looking 5–10 years ahead, Mastercard aims to remain a key player in the ongoing transition from cash to digital payments. Initiatives like open banking, contactless transit systems, and real-time cross-border payments could drive additional revenue. Assuming continued global consumption growth and cash displacement, Mastercard may achieve high single-digit (or better) annual revenue growth, which can translate into double-digit EPS growth given its operating leverage.

Here’s an illustrative 5-year dividend projection, assuming a ~15% annual dividend hike:

• 2025: $0.74 per quarter (annual $2.96)

• 2026: $0.85 per quarter (annual $3.40)

• 2027: $0.98 per quarter (annual $3.92)

• 2028: $1.13 per quarter (annual $4.52)

• 2029: $1.30 per quarter (annual $5.20)

These figures are hypothetical but underscore Mastercard’s potential for robust dividend compounding.

Qualitative Insights and Future Outlook

Synthesis and Strategic Insights

Mastercard’s global footprint, high-margin network model, and relentless push for payment innovation have enabled it to become one of the most profitable companies in finance. For dividend investors, MA may not offer the immediate yield of utilities or REITs, but its long-term capital appreciation and dividend growth can reward patient shareholders handsomely.

However, competition remains fierce—particularly from Visa, fintech upstarts, and even government-backed payment systems. Regulatory scrutiny of interchange fees and the risk of data breaches require ongoing vigilance. Still, Mastercard’s deep partnerships, massive acceptance network, and brand power form a formidable competitive moat, one that continues to deliver rising free cash flows and dependable shareholder returns.

Conclusion

In essence, Mastercard is a “growth dividend” play in a secular trend (the global shift from cash to electronic payments). As long as management remains focused on expansion, innovation, and disciplined capital allocation, investors can expect a balance of steady dividend hikes and share price appreciation—a winning formula for many dividend growth portfolios.

Warm Regards,

Zachary Gedal

Thank you for reading and continuing along on our Dividend Portfolio journey!