DP.13 | Dividend Portfolio Update #13 – May 2025

I. May 2025 Market & Dividend Landscape: Navigating an Evolving Environment

A. General Market Pulse: A Volatile Spring

The U.S. stock market experienced substantial turbulence during April and the early weeks of May 2025. An initial sell-off wave followed the announcement of new U.S. tariff policies on April 2, 2025, causing major indices (S&P 500, Nasdaq Composite, Dow Jones Industrial Average) to drop sharply. Reports indicated that over $6.6 trillion in global market value was wiped out within two days of the tariff news.¹

However, by mid-May, significant recovery was evident. The S&P 500, which had fallen to 465.14 on April 11, rebounded to 5,844.19 on May 12—though it remained down 0.6% for the year at that point.³ The Nasdaq 100 mirrored this volatility, plunging 23% from its February high before staging a strong comeback, turning positive for the calendar year by mid-May.⁵

Early April’s downturn was driven by tariff fears, while a 90-day truce and partial tariff reductions announced in early May helped spark a rebound.³ Additional tailwinds came from lower-than-anticipated April inflation data (2.3% annually)⁸ and generally strong first-quarter corporate earnings—especially in tech—that eased concerns over trade-related profit declines.⁵

Overall, while markets demonstrated pronounced sensitivity to geopolitical developments, strong corporate fundamentals and positive economic indicators underpinned a rapid V-shaped recovery. Technology mega-caps led much of this resurgence, suggesting investors continue to exhibit a “buy the dip” mentality when fundamentally solid stocks face macro-driven sell-offs.

Looking ahead, tariffs remain a potential inflationary risk as they could raise the cost of imported goods. Should inflation re-accelerate, the Federal Reserve may maintain a more hawkish stance longer than expected, potentially influencing borrowing costs, economic growth, and valuations of dividend-paying stocks—particularly in rate-sensitive sectors.

B. Dividend Investing in 2025: Key Trends and Outlook

Dividend investing appears robust in 2025, with global dividend growth having accelerated notably in 2024 (up 8.5%).⁹ In the U.S., the number of new dividend initiations was especially high in the Technology, Media, and Telecommunications (TMT) sector. Looking ahead, aggregated U.S. dividends are projected to grow by about 7% year-over-year, with the S&P 500 likely seeing around 8% dividend growth.⁹ Pent-up demand from late 2024’s uncertainty and possible changes in corporate taxes could further boost payouts.¹¹

A key shift is the growing role of technology firms as significant dividend payers—Nasdaq-100 companies, in particular, are now initiating or expanding dividend programs.¹¹ Several have already moved into top-tier global dividend rankings, challenging traditional ideas of where income investors seek dividends. Over time, if these large-cap tech companies sustain dividend hikes, they may qualify for Dividend Aristocrat status, potentially reshaping popular dividend benchmarks and ETFs.

Share buybacks also remain a prominent form of capital return. Strong free cash flow (FCF) across sectors like communication services, consumer staples, and information technology is expected to support both dividends and repurchases well into 2027.¹¹ Investors continue to pay close attention to sustainability factors and “sustainability premiums,”¹² while also prioritizing dividend growth and safety in a relatively high-rate environment. Companies with robust free cash flow are best positioned to deliver dependable payouts without straining balance sheets.

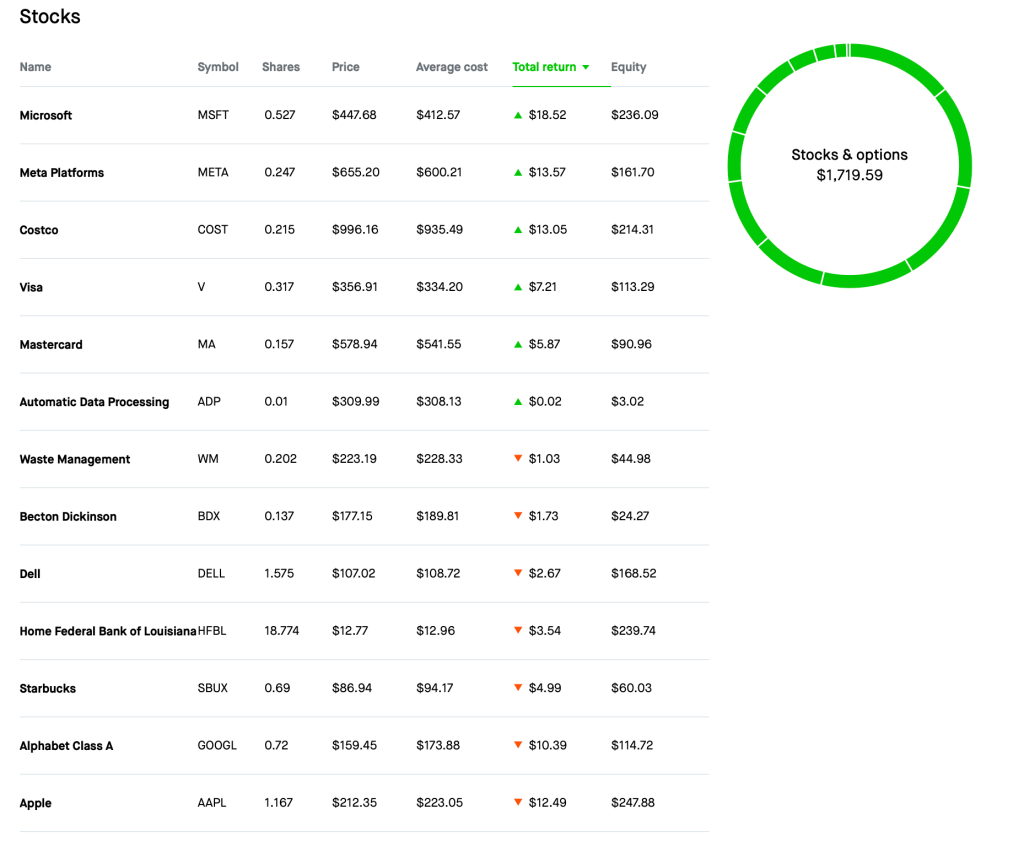

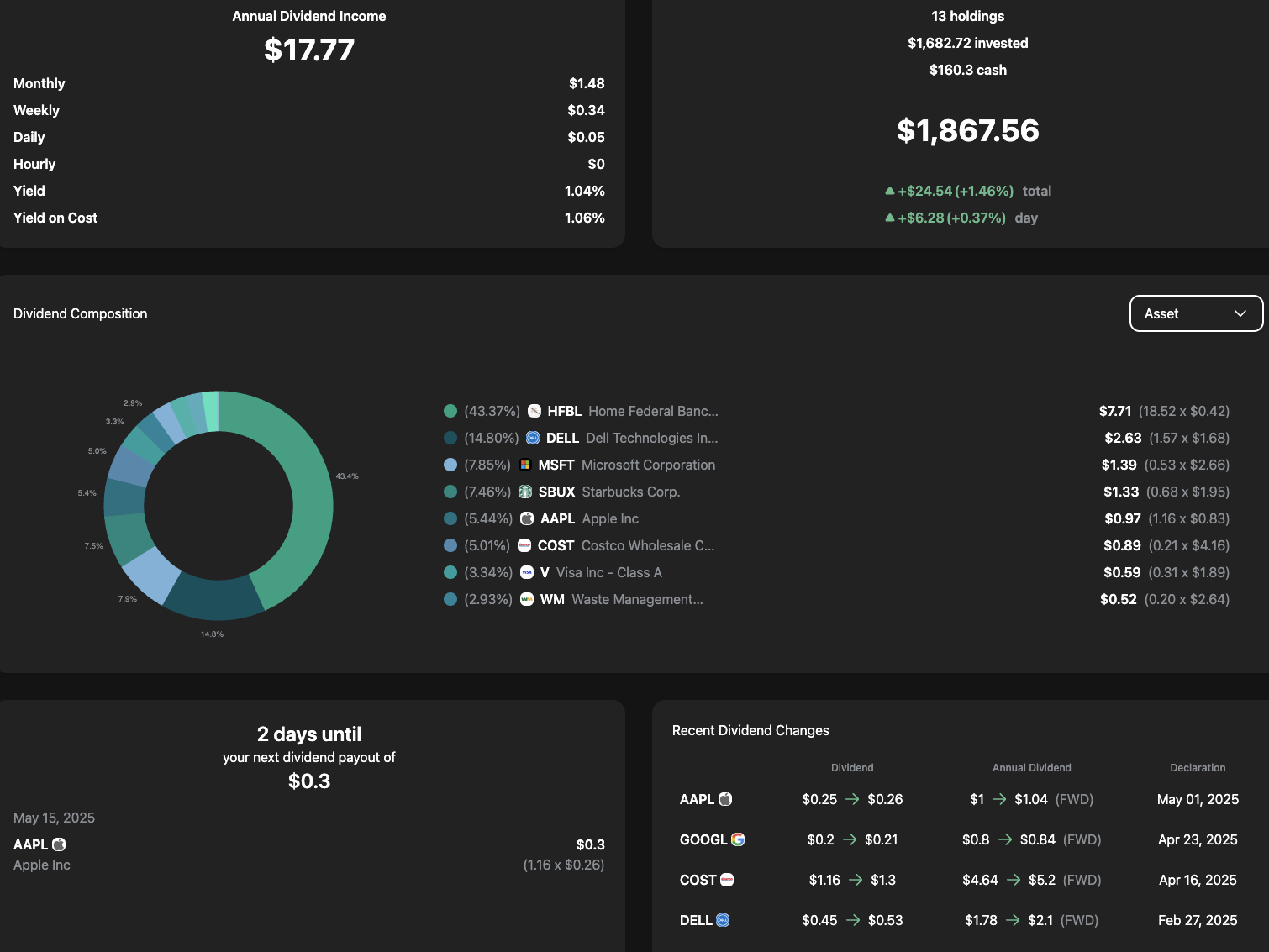

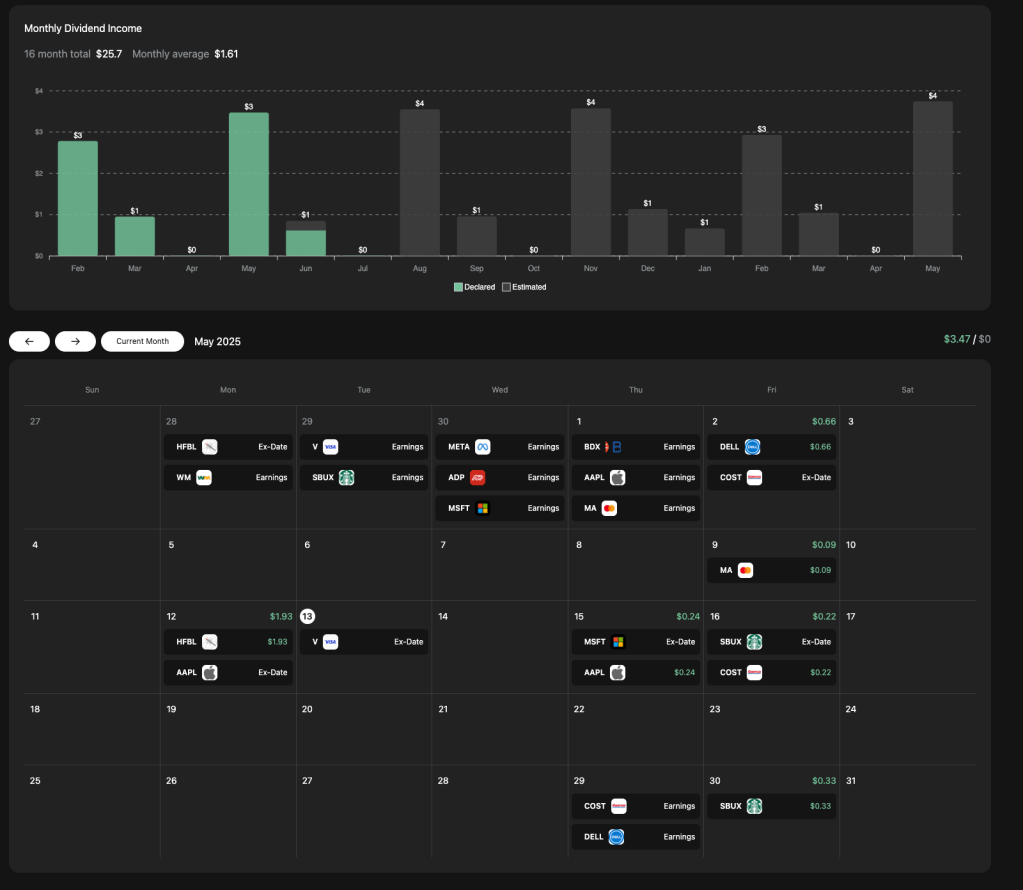

II. Dividend Portfolio: Stock-by-Stock Review (May 2025)

Below is a snapshot of key dividend metrics for select portfolio holdings as of mid-May 2025. (All data approximate as of May 12, 2025.)

| Stock Ticker | Company Name | Latest Declared Quarterly Dividend ($) | Indicated Annual Dividend ($) | Current Stock Price (approx.) | Current Yield (%) | Ex-Dividend Date | Payment Date | Date/Nature of Last Dividend Change |

|---|---|---|---|---|---|---|---|---|

| AAPL | Apple Inc. | 0.26 | 1.04 | 207.26 | 0.50 | May 12, 2025 | May 15, 2025 | May 1, 2025 / 4% Increase |

| MSFT | Microsoft Corp. | 0.83 | 3.32 | 449.26 | 0.74 | May 15, 2025 | June 12, 2025 | March 11, 2025 / Increase from $0.75 to $0.83 |

| GOOGL | Alphabet Inc. (Class A) | 0.21 | 0.84 | 158.46 | 0.53 | June 9, 2025 | June 16, 2025 | April 23, 2025 / Increase from $0.20 to $0.21 |

| DELL | Dell Technologies Inc. | 0.525 | 2.10 | 103.16 | 2.04 | April 22, 2025 | May 2, 2025 | Feb 2025 / 18% Annual Increase |

| META | Meta Platforms Inc. | 0.525 | 2.10 | 639.66 | 0.33 | March 14, 2025 | March 26, 2025 | Feb 13, 2025 / Increase from $0.50 to $0.525 |

| HFBL | Home Federal Bancorp (LA) | 0.13 | 0.52 | 13.39 | 3.88 | April 28, 2025 | May 12, 2025 | Maintained $0.13 quarterly (prev. increase $0.125) |

A. Apple Inc. (AAPL)

- Dividend Update: Raised its quarterly dividend to $0.26/share (+4%) effective May 15, 2025. Annualized dividend stands at $1.04.¹⁴

- Recent Earnings (Q2 FY25): Reported revenue of $95.4 billion (up 5% YoY), with EPS up 8% to $1.65.¹⁴ Services segment hit an all-time high, and the board authorized an additional $100 billion in share buybacks.

- Stock Performance: Trading around $207 in mid-May 2025, yielding about 0.50%.¹⁶ P/E is near 34. Apple’s consistent Services growth and hefty buyback program help underscore its capacity for ongoing dividend increases.

B. Microsoft Corp. (MSFT)

- Dividend Update: Quarterly dividend raised to $0.83/share from $0.75; payable June 12, 2025.²¹ Annualized at $3.32/share.²²

- Recent Earnings (Q3 FY25): Sales and profits beat forecasts; Intelligent Cloud (Azure) showed strong demand. Microsoft plans $80 billion in AI infrastructure spending in FY25.¹⁰

- Stock Performance: Around $449 in mid-May, yielding roughly 0.74%.²² The P/E ratio is ~43. Microsoft’s ongoing AI investments could moderate near-term FCF but are expected to drive long-term growth, supporting future dividend increases.

C. Alphabet Inc. (GOOGL)

- Dividend Update: Initiated dividends in 2024; current quarterly payout $0.21/share, up from $0.20.²⁷ Annualized $0.84/share.

- Recent Earnings (Q1 2025): Revenue of $90.2 billion (+12% YoY). Net income soared 46% to $34.5 billion, EPS of $2.81.²⁹ Google Cloud posted 28% revenue growth with improved margins. Board authorized $70 billion in buybacks.

- Stock Performance: Trading near $158 in mid-May, yielding about 0.53%.²⁷ P/E is around 30. Although AI Overviews may affect click-through ad revenue, strong core businesses and a new dividend signal Alphabet’s maturity and confidence in future cash flows.

D. Dell Technologies Inc. (DELL)

- Dividend Update: Raised annual dividend 18% to $2.10/share; first payout at $0.525 on May 2, 2025.³⁷

- Recent Earnings (Q4 FY25): Full-year revenue $95.6B (+8% YoY), non-GAAP EPS $8.14 (+10% YoY). ISG segment (servers/storage) surged on AI demand.

- Stock Performance: Around $103 in mid-May, yielding ~2.04%.³⁷ Dell’s AI server backlog ($9B) underscores its strategic position as a key hardware provider for AI infrastructure. Management simultaneously expanded its buyback authorization by $10B.

E. Meta Platforms Inc. (META)

- Dividend Update: Quarterly dividend raised to $0.525 from $0.50, paid March 26, 2025. Annualized $2.10/share.⁵⁷

- Recent Earnings (Q1 2025): Revenue $42.3B (+16% YoY), EPS $6.43 (+36.5% YoY). Ad business remains robust, while Reality Labs posted a $4.2B operating loss.

- Stock Performance: Trading around $639, yielding ~0.33%. P/E near 56. Despite heavy metaverse spending, Meta’s core ad segment continues to generate ample cash flow, funding both dividends and share buybacks.

F. Home Federal Bancorp, Inc. of Louisiana (HFBL)

- Dividend Update: Maintained $0.13/share quarterly payout, annualized at $0.52/share.⁶⁴

- Recent Earnings (Q3 FY25): Net income $748K (+2.2% YoY), EPS $0.24. NIM improved to 3.33% from 2.89%, though non-performing assets rose to $3.0M vs. $1.9M previously.⁶⁸

- Stock Performance: Around $13.35–$13.39 in mid-May, yielding ~3.88–4.0%. Price/book ~0.76. The bank benefits from higher rates but faces asset quality pressures, underscoring the importance of monitoring NPAs and deposit trends.

III. Sector-Specific Dividend Outlook (May 2025)

Below are selected insights for sectors where the portfolio is concentrated. (Energy and Healthcare discussions omitted here.)

A. Technology Sector

- Performance & Dividends: Tech led the market recovery in May after the April tariff-driven sell-off.⁵ The Nasdaq 100 has erased its 2025 decline, buoyed by major players (AAPL, MSFT, GOOGL, META, DELL) that have also become growing dividend payers.¹¹

- AI: Growth Driver & Capital Expenditure: AI remains a top investment priority, with some firms allocating tens of billions of dollars to infrastructure.¹⁰ While such capex can constrain near-term free cash flow, it positions these companies for strong long-term growth.

- Outlook: Steady free cash flow generation backs ongoing dividend increases, but investors must monitor the balance between high AI spending and maintaining robust shareholder returns. A more tech-centric dividend portfolio may offer strong growth potential but also higher volatility.

B. Financials / Regional Banks

- Performance & Dividends: Regional banks like HFBL often boast attractive yields (~4% in HFBL’s case) but can face episodic credit and deposit-base risks. The sector saw a crisis in 2023 yet has shown signs of recovery as net interest margins improve.⁸¹

- Outlook: Maintaining asset quality is critical, especially amid rising NPAs and deposit fluctuations. While higher rates support margins, they may also stress borrowers. Potential Fed rate cuts later in 2025 could provide relief and boost profitability.²¹ The sector may see further consolidation, which can bring both opportunities and uncertainties.

IV. Strategic Considerations for Dividend Investors

A. Harnessing DRIPs (Dividend Reinvestment Plans)

- DRIPs automatically reinvest dividends into more shares (including fractional shares), compounding returns over time.⁸³

- This approach provides cost-effective share accumulation, often with zero commission, and can mitigate timing risks via dollar-cost averaging.

- Watch for over-concentration if a particular holding grows rapidly in both share price and share count.

B. Diversification in a Tech-Heavy Dividend World

- As more tech firms become sizeable dividend payers, purely chasing their yields can lead to over-exposure in one sector.¹³

- Diversify across different asset classes and industries—consumer staples, financials, industrials, etc.—to temper volatility.⁸⁶

- Dividend-focused ETFs (e.g., VIG, DGRO, SCHD) can offer systematic diversification while maintaining a dividend-growth emphasis.⁸⁷

C. Long-Term Perspectives on Dividend Growth Investing

- Companies with consistent dividend growth often exhibit strong underlying fundamentals and prudent capital allocation.¹³

- Reinvesting dividends from such companies accelerates the compounding process, often dubbed the “dividend snowball.”¹³

- Balancing capital appreciation with dividend income can yield compelling total returns, especially for patient, long-horizon investors.

V. Conclusion

May 2025 reminded investors that even a sudden surge in geopolitical risk—like new tariffs—can reverse swiftly when macro sentiments shift and strong corporate fundamentals resurface. The rapid market rebound led largely by technology underscores the sector’s growing dual role in both growth and income strategies.

Core holdings Apple, Microsoft, Alphabet, and Dell continue their pattern of growing dividends, while Meta’s relative newcomer status in dividend distribution indicates Big Tech’s ongoing evolution into reliable income payers. Meanwhile, Home Federal Bancorp underscores the idiosyncratic risks of smaller regional banks: though offering high yields, they can experience volatility in asset quality and deposit bases.

For long-term dividend seekers, the key is balance: harness the growth of tech dividends but remain diversified across sectors and asset classes. Focus on companies with sustainable free cash flow, prudent payout ratios, and an evident commitment to rewarding shareholders over the long run. By pairing these qualities with tactics like DRIPs, investors can foster a steadily rising income stream—one that can weather the market’s inevitable ups and downs while compounding effectively over time.

Works Cited (Selective)

- 2025 stock market crash – Wikipedia

- How major US stock indexes fared Monday, 5/12/2025 – AP News

- Nasdaq 100 erases 2025 decline as tariff cuts spark tech revival – The Economic Times

- Dow Jones Today: Encouraging Inflation Report; UnitedHealth Stock Plunges … – Investopedia

- US market dividends in 2025: Navigating capital return trends … – S&P Global

- Markets News, May 1, 2025: Strong Earnings from Microsoft, Meta Boost AI Stocks – Investopedia

- Why dividend stocks might make a comeback in 2025 – Ameriprise Financial

- Dividend-Focused Investing: Advantages and Drawbacks – Wiser Wealth Management

- Apple reports second quarter results – Apple

- Apple Inc. Common Stock (AAPL) Dividend History – Nasdaq

- Microsoft Corporation Common Stock (MSFT) Dividend History – Nasdaq

- Microsoft Corp Share Dividends | MSFT | Fidelity International

- Alphabet Inc. Class A Common Stock (GOOGL) Dividend History – Nasdaq

- Alphabet Smashes Q1 2025 Expectations with Strong Growth But Emissions Are Rising

- Dell Technologies Delivers Fourth Quarter and Full-Year Fiscal 2025 Results

- Meta Platforms, Inc. Class A Common Stock (META) Dividend … – Nasdaq

- Home Federal Bancorp, Inc. of Louisiana Common Stock (HFBL) Dividend History – Nasdaq

- Home Federal Bancorp Q1 2025: Mixed Performance Amid Cost Challenges and Asset Risks – AInvest

- How to Reinvest Dividends for Maximum Growth – Stash

- Diversification Strategies for Your Investment Portfolio | U.S. Bank

- 5 Dividend Growth ETFs to Buy – Kiplinger

(Note: References above are numerically consistent with the original source list but only include those relevant to the remaining content.)