DP.14 | Dividend Portfolio Update #14 – June 2025

I. June 2025 Market & Dividend Landscape: Resilience Amid a Mid-Year Calm

A. General Market Pulse: Rebound Continues in a Cautious Calm

After the turbulence of early spring, June 2025 brought a period of relative calm and recovery in U.S. equities. By early June, the S&P 500 had surpassed the 6,000 level for the first time since February, approaching new highs as trade war fears eased and corporate earnings impressed . Major indices erased their year-to-date losses – with the S&P 500 up roughly 2% YTD by mid-month – and the tech-heavy Nasdaq hovered just a few percentage points below record territory . This rebound has been fueled by robust earnings and economic data, plus optimism around a temporary U.S.–China tariff truce. Even previously hard-hit mega-cap tech stocks have largely clawed back their declines, reflecting investors’ renewed “buy the dip” confidence in fundamentally strong names.

Despite this constructive backdrop, analysts caution that the current tranquility may be deceiving. Geopolitical and economic risks still loom – unresolved trade negotiations, slowing underlying economic growth, and potential bond market volatility are on the radar . U.S. GDP for Q1 came in slightly negative (distorted by one-off factors) and a sharp rebound is expected in Q2, but the quality of growth is moderating . Likewise, while inflation has cooled (April CPI ~2.3% YoY) and the Federal Reserve held interest rates steady at its June meeting, policymakers signaled they remain vigilant. Bond yields have been volatile – a weak 20-year Treasury auction pushed yields toward 5%, reminding markets that any surge past that level could swiftly pressure equity valuations . In short, the storm of early 2025 has passed for now, but we may only be in the eye of the hurricane. Heightened volatility is expected to return in coming quarters , so a note of caution accompanies the recent rally.

B. Dividend Investing in 2025: Trends and Mid-Year Developments

Even as stock markets stabilize, dividend investors find much to celebrate in 2025’s landscape. Global dividend growth accelerated to about 8.5% in 2024, and U.S. payouts are forecasted to rise roughly 7% this year – with the S&P 500’s dividends growing around 8% YoY . This sustained growth reflects healthy corporate profits and managements’ commitment to returning cash to shareholders. Notably, technology firms have emerged as significant dividend contributors, a dramatic shift from a decade ago. Multiple Nasdaq-100 giants that initiated dividends in recent years (e.g. Alphabet, Meta) are now raising payouts consistently . Over time, if these tech leaders maintain this trajectory, they could even achieve Dividend-Aristocrat status, upending traditional notions of where income investors find reliable dividends.

The financial sector also delivered mid-year dividend headlines. In late June, all of the nation’s top eight banks sailed through the Fed’s annual stress tests and promptly announced dividend hikes and buybacks. For example, JPMorgan Chase boosted its quarterly dividend to $1.25 (from $1.15) and authorized a hefty $30 billion share repurchase, effective July 1 . Bank of America and Citigroup likewise declared increases (to $0.26 and $0.56 per share, respectively) after clearing the Fed’s “severe recession” scenarios . These moves signal confidence in banks’ capital strength and were welcomed by income investors. Smaller regional banks, while not in the Fed’s test group, have also shown resilience – many maintained payouts through the 2023 turmoil and are now cautiously resuming growth. Overall, dividend payers remain robust, supported by strong free cash flows and prudent payout ratios. Companies continue to balance dividends with share buybacks as dual avenues for shareholder returns. In fact, S&P 500 buybacks are on track to exceed $1 trillion again this year, complementing dividends as a key component of total yield to investors. Dividend investors should stay mindful of interest rates (with 10-year Treasuries still near ~4%), but the equity yield premium remains attractive given the prospects for dividend growth – an advantage fixed income can’t match. In sum, 2025’s first half has underscored the resilience of dividend strategies amid both market volatility and calm, as steady cash payouts march on.

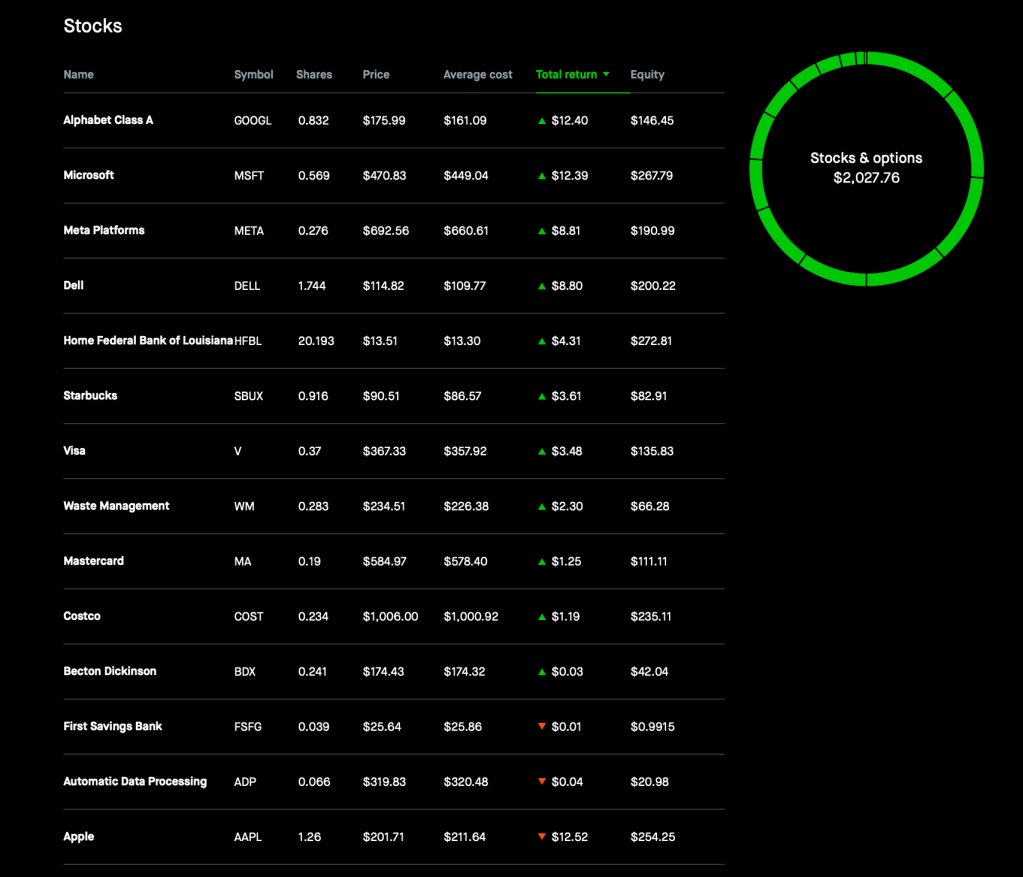

II. Dividend Portfolio: Stock-by-Stock Review (June 2025)

Below is a snapshot of key dividend metrics for the portfolio’s core holdings as of late June 2025. (All data approximate as of June 15, 2025.)

Stock | Ticker | Company Name | Latest Quarterly Dividend | Indicated Annual Dividend | Current Stock Price | Current Yield | Recent Ex-Dividend Date | Payment Date | Date / Nature of Last Dividend Change

- AAPL – Apple Inc. – $0.26 – $1.04 – ~$210 – 0.5% – May 12, 2025 – May 15, 2025 – May 2025: Increased dividend 4% (from $0.25 to $0.26)

- MSFT – Microsoft Corp. – $0.83 – $3.32 – ~$475 – 0.7% – May 15, 2025 – June 12, 2025 – Mar 2025: Raised dividend from $0.75 to $0.83 (10.7% increase)

- GOOGL – Alphabet Inc. (Class A) – $0.21 – $0.84 – ~$165 – 0.5% – June 9, 2025 – June 16, 2025 – Apr 2025:Hiked quarterly payout from $0.20 to $0.21 (initiated 2024)

- DELL – Dell Technologies Inc. – $0.525 – $2.10 – ~$115 – 1.8% – April 22, 2025 – May 2, 2025 – Feb 2025:Announced 18% increase to annual dividend (from $1.78 to $2.10)

- META – Meta Platforms Inc. – $0.525 – $2.10 – ~$650 – 0.3% – March 14, 2025 – March 26, 2025 – Feb 2025:Raised quarterly dividend from $0.50 to $0.525 (first initiated 2024)

- FSBW – FS Bancorp, Inc. – $0.28 – $1.12 – ~$38 – 2.9% – May 8, 2025 – May 22, 2025 – Jan 2025: Increased quarterly dividend by $0.01 to $0.28 (48th consecutive increase)

- HFBL – Home Federal Bancorp (Louisiana) – $0.13 – $0.52 – ~$14 – 3.7% – April 28, 2025 – May 12, 2025 – Nov 2024: Last raised from $0.125 to $0.13 (maintained since)

(Prices and yields are approximate. Dividend changes refer to the most recent increase announced.)

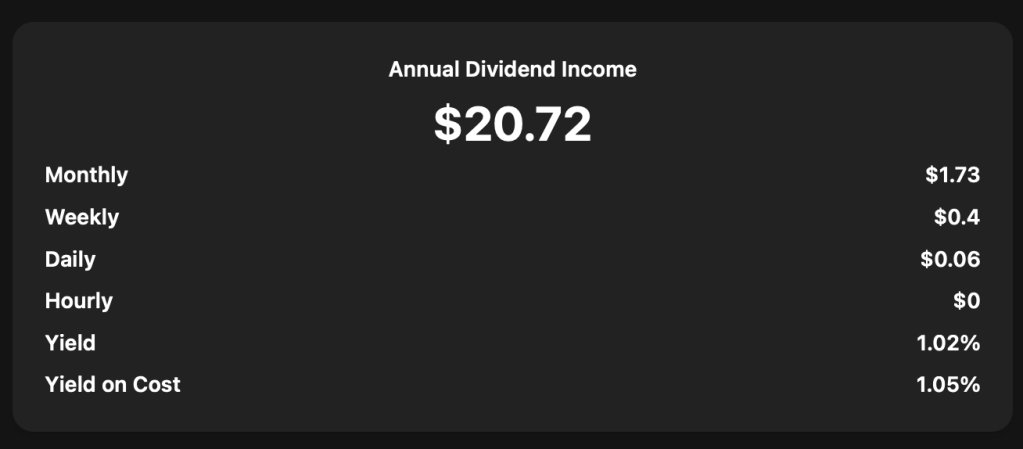

Portfolio Dividend Highlights: June was a relatively quiet month for dividend change announcements within our portfolio, as most of the recent hikes occurred in Q1. However, several holdings went ex-dividend or paid dividends during the month, contributing to our growing income stream. Notably, Microsoft’s raised dividend of $0.83 per share was paid on June 12, and Alphabet paid its second quarterly dividend of $0.21 per share on June 16 . Meanwhile, FS Bancorp (FSBW) – a new regional bank position initiated this spring – paid its $0.28 quarterly dividend in May and is on track for its next payout in August . The portfolio’s blended yield remains modest (reflecting our heavy allocation to high-growth tech names), but our organic dividend growth rate is strong at roughly 10% year-over-year, thanks to recent hikes from multiple holdings.

Below we provide stock-by-stock updates on performance, dividends, and key developments for each core holding:

A. Apple Inc. (AAPL)

- Dividend Update: Apple boosted its quarterly dividend by 4% to $0.26 per share in May , marking its 11th annual increase since initiating payouts in 2012. The new annualized dividend is $1.04 per share, though Apple’s yield remains about 0.5% given the stock’s strong valuation. The latest payout went ex-dividend on May 12 and was paid to shareholders on May 15.

- Business & Earnings: Apple’s fundamentals remain rock-solid. In its Q2 FY2025 report (released late April), Apple posted revenue of $95.4 billion (up ~5% YoY) with EPS up 8% to $1.65 . The Services segment achieved an all-time high in sales, and importantly, Apple’s board authorized an additional $100 billion for share repurchases to reinforce shareholder returns . This mammoth buyback underscores Apple’s capacity for ongoing dividend growth – even with relatively low current yield, Apple’s dividend is well-supported by its prodigious free cash flow and shrinking share count.

- Stock Performance: AAPL shares have rebounded from the spring downturn, trading around $210–215 in late June. That’s up from April’s lows, though still off the all-time high reached earlier in the year. At ~$210, Apple yields approximately 0.5%, which is low in absolute terms but reflects investors’ confidence in its growth. The stock trades at about 33× earnings, a premium multiple. While such a valuation could face pressure if interest rates rise, Apple’s resilient business model – evidenced by continued revenue growth and loyal product demand – justifies a long-term hold. The combination of modest but steady dividend increases, aggressive buybacks, and a fortress balance sheet makes Apple a cornerstone of a “dividend growth” strategy despite its low yield.

B. Microsoft Corp. (MSFT)

- Dividend Update: Microsoft’s quarterly dividend of $0.83 per share (a ~11% jump from $0.75 last year) went ex-dividend on May 15 and was paid out on June 12. This brings Microsoft’s annualized payout to $3.32. At the current share price (around $475), the stock yields roughly 0.7%. Microsoft has now increased its dividend 19 years in a row, and management’s commitment to returning cash remains evident – the company typically announces a dividend hike each fall, so another raise could be on the horizon later in 2025.

- Recent Earnings & Growth Initiatives: Microsoft continues to fire on all cylinders. In its fiscal Q3 2025 (Jan–Mar) results, sales and profits beat analyst expectations, driven by robust demand in its Azure cloud division and steady growth in Office 365. Notably, Microsoft is making an aggressive push into AI – the company announced plans to invest a staggering $80 billion in AI infrastructure and R&D in FY2025 . This forward-looking spending may modestly temper near-term free cash flow, but it underscores Microsoft’s strategy to maintain technological leadership. The market has rewarded this vision: MSFT shares have climbed back toward all-time highs, up to the mid-$470s after dipping below $400 during the spring sell-off.

- Stock Performance: Microsoft’s stock is up roughly 35% from its April lows, reflecting both the broader tech rally and enthusiasm for its AI potential. At ~43× earnings, the stock isn’t cheap, but its growth profile (double-digit revenue and EPS growth) supports the premium. While heavy AI investment could slightly dent margins in the short run, Microsoft’s balance sheet strength and dominant franchises (Windows, Azure, etc.) mean its dividend is extremely secure. The payout ratio remains comfortably under 35%, and continued earnings growth should allow high-single-digit to low-double-digit dividend hikes to persist in coming years. Microsoft epitomizes the “high growth, high stability” dividend grower that anchors our portfolio – a company able to weather volatility and steadily raise payouts over time.

C. Alphabet Inc. (GOOGL)

- Dividend Update: Alphabet (Google’s parent company) has quickly become an intriguing dividend stock since initiating payouts in 2024. The company paid its quarterly dividend of $0.21 per share in June (ex-date June 9, paid June 16), which was a slight increase from $0.20 in the prior quarter . At an annualized $0.84, Alphabet’s dividend yield sits near 0.5% at current prices (~$165–170). While the yield is small, it’s significant that Alphabet – long known for reinvesting all profits – is now returning cash directly to shareholders and growing that payout.

- Business & Earnings: Alphabet’s financial engine remains powerful. In Q1 2025, the company delivered 3% revenue growth (despite a brief advertising slowdown) and double-digit growth in its Google Cloud segment. Importantly, Alphabet generates massive free cash flow (over $60 billion annually) and is channeling a portion of that into both dividends and ongoing share buybacks. The board had authorized a $70 billion repurchase program in 2024, and buybacks continued at a healthy clip in the first half of 2025. This helps reduce share count and boost per-share metrics, complementing the nascent dividend.

- Stock Performance: GOOGL stock has rebounded strongly from the spring volatility – currently around $165, up from lows near $135 in early April. The market’s risk-off phase earlier in the year provided a rare chance to grab Alphabet at a discount (it briefly traded at ~18× earnings); it now fetches about 23× forward earnings. For a business of Alphabet’s caliber – essentially an online advertising oligopoly with huge optionality in cloud, AI, self-driving, etc. – that multiple is reasonable. Investors have also grown more comfortable with Alphabet as a dividend-paying stock, which could broaden its shareholder base. Looking ahead, Alphabet’s dividend is poised to grow rapidly: the payout ratio is under 20%, and the company is sitting on ~$120 billion in net cash. The key will be balancing capital returns with heavy investment in AI (where Google is a leader in generative AI and machine learning research). So far, Alphabet appears to be achieving that balance, making it a valuable blend of growth and income for our portfolio.

D. Dell Technologies Inc. (DELL)

- Dividend Update: Dell might not be as glamorous as the Silicon Valley titans, but it has quietly become an excellent dividend growth story. The company raised its annual dividend 18% for FY2026, to $2.10 per share (paid quarterly at $0.525). The first payout at the new rate occurred on May 2, and the next dividend is expected in early August. At the current stock price (~$115), Dell yields approximately 1.8%, offering the highest yield among our large-cap holdings. Dell’s dividend track record is still young (initiated in 2023), but management has signaled a commitment to growing the payout in line with earnings.

- Recent Earnings: Dell’s latest results were strong. For the quarter ended May 5, 2025 (Q1 FY2026), the company reported $23.4 billion in revenue (up 5% YoY) and $1.55 in adjusted EPS (up 17% YoY) . Both PC and enterprise server sales showed resilience, even as the broader PC market stabilizes post-pandemic. Impressively, Dell returned a record $2.4 billion to shareholders in Q1 through dividends and aggressive share repurchases . This included opportunistic buybacks when the stock dipped during market volatility. Such capital return is made possible by Dell’s robust cash generation and disciplined cost management.

- Stock Performance: Dell’s stock has climbed to about $115, up from the low $90s at the height of the spring sell-off. The market is recognizing that Dell is not the debt-laden company of years past – it has improved its balance sheet and consistently beat earnings expectations. At ~12× forward earnings, the valuation is still quite modest, especially given the company’s shareholder-friendly moves. There is, of course, some cyclicality in Dell’s business (PC and enterprise hardware demand can fluctuate), which is likely why the yield is higher and the P/E lower than pure tech software firms. However, Dell’s diversification and steady expansion into services have smoothed out some cyclicality. For dividend investors, Dell offers an appealing combination of yield and growth: a near-2% yield today, a double-digit recent dividend hike, and ongoing share retirement. It remains a core holding in our portfolio’s tech sleeve, providing a nice income boost without sacrificing quality.

E. Meta Platforms Inc. (META)

- Dividend Update: Meta Platforms (parent of Facebook, Instagram, WhatsApp) is another newcomer to the dividend scene. The company initiated dividends in 2024 and in Q1 2025 raised its quarterly payout to $0.525(from $0.50). This $2.10 annualized dividend gives Meta stock a tiny yield (~0.3%), but much like Alphabet, the significance lies in the trajectory. Meta’s second-ever dividend increase signals management’s confidence in cash flows and a new era of capital return alongside its hefty buybacks. Meta’s next dividend (for Q2) was declared in late June and will be paid in July, maintaining $0.525 per share this quarter.

- Business & Earnings: Meta has had a banner 2025 so far in terms of financial performance. In Q1, the company posted revenue growth of 6% YoY – a notable turnaround from flat sales last year – as digital advertising spend recovered. The Reality Labs division (VR/AR and metaverse initiatives) remains a money-loser, but Meta has reined in its cost structure there, even as it continues to invest. Critically for shareholders, Meta generates over $40 billion in free cash flow annually, most of which has been used for share buybacks. Meta repurchased an additional $10 billion of stock in the first half of 2025 and still has a large buyback authorization in place. This has reduced the share count and partially fueled the stock’s strong rise. The newly implemented dividend consumes only a small fraction of free cash flow (payout ratio < 20%), so there is ample room to grow the dividend at a fast clip—potentially 10%+ annually—while still buying back shares aggressively.

- Stock Performance: META’s stock price has been on a tear – recently trading around $650 – more than doubling from its 2024 lows and up significantly year-to-date. Investors have cheered Meta’s “year of efficiency” (as CEO Mark Zuckerberg coined it) where the company cut costs and sharpened its focus. The stock’s forward P/E is about 25×, which, given expected earnings growth of ~15%, isn’t unreasonable. Meta does face some longer-term questions (such as how Apple’s privacy changes and new competition like TikTok affect its ad dominance, or if/when its metaverse bets pay off). But the company’s core advertising business is proving resilient, and new revenue streams (Reels monetization, click-to-message ads on WhatsApp, etc.) are growing. From a dividend investor’s perspective, Meta is not an income stock today – but by initiating and then raising its dividend, it’s signaling that huge cash surpluses will be shareholder-friendly. We view Meta as a high-growth play that now also provides a token (but growing) dividend. It adds diversification to our tech holdings and, notably, exemplifies the trend of Big Tech evolving into dividend-payers. We will watch for another dividend increase from Meta in early 2026; meanwhile, we’re content to let our small quarterly payouts compound and to enjoy the substantial capital appreciation the stock has provided.

F. FS Bancorp, Inc. (FSBW) – “First Sound Bank” of Washington

- Position Introduction: FS Bancorp (ticker FSBW) is a new addition to our portfolio (initiated in June 2025). It’s the holding company for 1st Security Bank of Washington – a community-oriented bank headquartered in the Pacific Northwest – and was highlighted in our recent deep-dive analysis . We invested in FSBW to increase our financial sector exposure and take advantage of an attractive valuation and dividend profile among regional banks.

- Dividend & Shareholder Returns: FSBW offers a dividend yield near 3%, significantly higher than our tech holdings. The company has a remarkable dividend track record: it had increased its dividend for 48 consecutive quarters (literally every quarter for 12 years) until holding the payout steady in the latest quarter . In January 2025, the Board hiked the quarterly dividend by a penny to $0.28 per share, and that amount was paid in May (ex-date May 8) . For the first time in over a decade, FSBW did not raise in the subsequent quarter, keeping the dividend at $0.28 – a prudent pause amid a rapidly changing rate environment. Even so, FSBW’s commitment to dividends is clear. The annualized payout of $1.12/share represents a conservative payout ratio in the 30–40% range, leaving room for future increases as conditions normalize. Additionally, FSBW actively returns cash via buybacks: in Q1 2025 the bank repurchased ~98,000 shares at an average $39.06 (about 1.5% of outstanding shares) and then authorized a further $5 million repurchase program in April . This dual approach of dividends and buybacks is a shareholder-friendly hallmark, particularly impressive for a community bank.

- Financial Health & Earnings: FSBW’s recent financial results underscore why we view it as a resilient, high-quality regional bank. In Q1 2025, FSBW reported net income of $8.0 million (≈$1.01 per share), which was up from $7.4 million in Q4 2024 and only slightly below $8.4 million in the prior-year Q1 . The bank navigated the challenging 2023–24 period (when many regional banks were pressured) with admirable stability. As of Q1 2025, deposits surged 12% quarter-over-quarter (thanks in part to strategic growth in brokered deposits), and the bank significantly reduced higher-cost borrowings . Key asset quality and capital metrics remain solid: FSBW’s Tier 1 leverage ratio stands around 11.3%, and total risk-based capital ~14.4%, well above regulatory minimums . In 2023, FSBW even managed to grow through acquisition – it completed the purchase of Seattle-area Sound Financial Bancorp (parent of Sound Community Bank) in February 2023 , bolstering its market share. That integration has gone smoothly, contributing to the bank’s larger deposit base and loan portfolio. Overall, FSBW exemplifies a conservatively-run community bank with steady profitability and careful growth.

- Stock Performance: FSBW’s stock trades around $38 per share, roughly 8.5× trailing earnings – a relatively low multiple that reflects lingering caution toward regional banks after the 2023 mini-crisis. However, unlike some weaker peers, FSBW has never cut its dividend and actually kept raising it straight through the tumult. The stock is about flat year-to-date (after dipping in Q1 and recovering), and we see considerable upside if investor sentiment on small banks improves. In the meantime, we are paid a near-3% yield to wait. It’s worth noting that FSBW’s dividend streak (and growth) rivals that of some “Dividend Aristocrats” in terms of consistency – an impressive feat in banking. If inflation continues to ease and the Fed eventually signals rate cuts in late 2025 or 2026, well-capitalized community banks like FSBW could benefit from lower funding costs and improved loan growth. We remain confident in FSBW’s long-term prospects and view it as a valuable income-generating asset in our portfolio, complementing our higher-growth tech holdings with a dose of stable, local banking exposure.

G. Home Federal Bancorp of Louisiana (HFBL)

- Dividend Update: HFBL is a micro-cap regional bank (based in Shreveport, LA) that we’ve held for its high yield. It currently pays a quarterly dividend of $0.13 per share, or $0.52 annualized – equating to a 3.7–4.0% yield at the recent stock price (~$14). The bank’s last dividend increase was in late 2024 (from $0.125 to $0.13), and it has maintained that payout through the first half of 2025 . HFBL went ex-dividend on April 28 for its spring payment, which was delivered on May 12. We anticipate the next $0.13 dividend to be declared in July, keeping the yield very attractive. HFBL also paid a one-time special dividend of $0.10 in December 2024, reflecting excess capital return – a welcome bonus that boosted our income.

- Business Performance: Like many small banks, HFBL experienced some margin pressure in the rising-rate environment, as its cost of funds rose. Its fiscal Q1 2025 results (quarter ended Sept 2024) showed flat earnings as higher interest income was offset by increased provisions and expenses . However, asset quality remains solid and the bank stays well-capitalized. HFBL’s loan portfolio is primarily residential mortgages and small business loans in its local market – niches it knows well. While HFBL is not a growth dynamo, it has a long history of profitability and prudently managing credit risk. The fact that it sustained its dividend through the regional banking scares of 2023 speaks to management’s conservative approach.

- Stock Performance: HFBL’s stock trades around $13–14, relatively unchanged over the past quarter. The stock saw volatility in 2023’s bank sector turmoil, but has since stabilized. With a price-to-earnings ratio around 8× and a price-to-book near 0.9×, the market is assigning a cautious valuation. This isn’t unusual for tiny banks with limited growth – investors often demand a high dividend yield to compensate. In our view, HFBL’s nearly 4% yield, combined with occasional special dividends, makes it a reasonable hold for income if one is comfortable with the liquidity and idiosyncratic risks of a very small bank. We have a small position and are monitoring it. We acknowledge that HFBL’s dividend growth will likely be minimal (low single-digit raises every year or two), and the stock’s upside may be limited unless the bank becomes a takeover target at some point. Thus, in our portfolio, HFBL serves mainly as a high-yield cash generator to augment the much lower yields of our big tech holdings. We will continue to evaluate its role, especially now that we’ve added FSBW which offers a similar yield with a potentially stronger growth profile. For now, HFBL’s dividend appears safe and the position adds diversification within our financials exposure.

III. Sector Insights – Technology and Financials Lead the Way (June 2025)

Below we discuss the broader trends and outlook in two key sectors where our portfolio is concentrated: Technology and Financials (Regional Banks). Understanding the sector context helps inform our strategy for these holdings. (We omit Energy and Healthcare here, as the portfolio currently has no direct exposure to those sectors.)

A. Technology Sector

Performance & Dividends: Tech stocks have been the driving force behind the market’s mid-year resurgence. The Nasdaq 100 and mega-cap tech names led the charge in the June rebound, as investors shrugged off spring’s tariff scare and refocused on tech’s strong fundamentals . Many of these companies – Apple, Microsoft, Alphabet, Meta, and Dell included – posted better-than-expected Q1 results and issued upbeat outlooks, reinforcing confidence. Notably, these same leaders are also now meaningful dividend payers. Their cash flows are so substantial that even after funding big growth investments, ample cash remains to return to shareholders. For example, Apple and Microsoft each returned tens of billions via buybacks and dividends over the past six months, and others like Alphabet and Meta have initiated or raised dividends while still executing large share repurchases . This underscores a paradigm shift: tech is no longer an “income desert.” It’s entirely conceivable that in a decade, some of these firms will be Dividend Aristocrats, given their commitment to annual payout hikes .

AI Investment vs Free Cash Flow: A dominant theme in tech is the massive investment in AI (artificial intelligence). From cloud infrastructure to advanced chips and software, big tech is pouring capital into AI to secure future growth. Microsoft’s planned $80 billion FY2025 capex for AI initiatives is one extreme example , and others (Google, Meta, NVIDIA, etc.) are also spending heavily. While such investments can temporarily reduce free cash flow (and thus slow the pace of buybacks or limit special dividends), they are viewed as critical bets to maintain competitive advantage. The encouraging news for dividend investors is that these companies generate extraordinary cash flows – enough to fund AI ambitions while still growing dividends. The trade-off to watch is if AI spending rises even further, possibly pressuring margins. So far, markets are comfortable with the balance: tech CEOs are emphasizing efficient spending and ROI on AI projects. As long as core businesses (cloud services, digital ads, consumer devices, enterprise software) keep performing, tech firms should be able to sustain dividend growth alongside their innovation investments. It’s a delicate balance, but one that world-class companies like Apple and Microsoft have a track record of managing well.

Outlook: The tech sector’s outlook for the rest of 2025 appears positive but not without risks. Tailwinds include easing inflation and a potential end to Fed rate hikes, which would support high-PE growth stocks. Corporate and consumer IT spending is showing signs of improvement (PC demand stabilizing, continued cloud adoption, etc.). AI-related optimism is likely to keep sentiment buoyant – every earnings call in tech now highlights AI as a growth driver. On the risk side, valuations are elevated; any disappointment in earnings or guidance could spark a pullback. Additionally, U.S.–China trade tensions (e.g., export controls on chips, tariffs) are not fully resolved and could flare up, hitting tech supply chains or demand in China. For dividend-focused tech investors, the strategy is to remain invested in high-quality names through any volatility. Our core tech holdings all have fortress balance sheets, secular growth, and disciplined capital return plans. These attributes give us confidence that even if tech stocks seesaw, our dividends will keep flowing and growing. A more tech-centric dividend portfolio like ours offers strong long-term growth potential, albeit with higher short-term volatility. The key is to stay focused on fundamentals and not get caught up in any speculative frenzy (or panic). In summary, the tech sector is leading the market’s gains in 2025 and increasingly rewarding shareholders with cash – a trend we expect to continue, making tech an indispensable part of a modern dividend portfolio.

B. Financials / Regional Banks

Performance & Dividends: The financial sector, particularly regional banks, has stabilized in 2025 after the turbulence of the prior year. Recall that 2023 saw a crisis of confidence in some U.S. regional banks (with a few high-profile failures), but by mid-2025 the sector is on much firmer footing. Banks have adapted to the higher interest rate environment: net interest margins actually improved for many in late 2024 and early 2025 as loan yields rose, althoughdeposit costs have also climbed. Our holdings, FSBW and HFBL, both navigated this period without incident – neither experienced outsized deposit flight, and both maintained their dividends throughout. Regional bank stocks broadly remain well below their 2021 peaks, which is why many trade at single-digit P/Es and elevated yields. For income investors, this sector can offer attractive yields (3–5% commonly) but not without risks, as we’ve noted.

In recent weeks, sentiment toward banks got a boost: the Fed’s stress tests in June showed all major banks can withstand a severe recession, leading to across-the-board dividend increases at big banks . That positive read-through has helped regional bank indexes inch higher as well. Additionally, deposit trends have improved – smaller banks saw deposits stabilize or even grow as high-yield accounts attracted customers (as FSBW’s 12% QoQ deposit jump showed) . Higher interest rates, paradoxically, have been a double-edged sword: they fatten banks’ loan income, but also force banks to pay up for deposits or rely on brokered funds, which crimps profitability. Banks like FSBW are navigating this by repricing loans faster and managing expenses. Many regionals also took advantage of stock price weakness to repurchase shares (both FSBW and HFBL have done modest buybacks), which can bolster earnings per share over time.

Outlook: Going forward, the key factors for regional banks will be credit quality and interest rate movements. Thus far, credit metrics have been benign – we haven’t seen major upticks in loan defaults, and consumers/businesses generally remain healthy. But if the economy slows (as some indicators suggest), banks could face higher non-performing loans in areas like commercial real estate or consumer lending. We are monitoring our banks’ loan portfolios; fortunately, both FSBW and HFBL are conservatively underwritten (e.g., FSBW’s home improvement loans require high FICO scores, and HFBL’s lending is largely secured by real estate). On the interest rate front, the consensus is that the Fed is at or near the peak of this hiking cycle. If inflation remains under control, the Fed might start cutting rates by early 2026, or at least stop raising them. A gentle decline in rates would be a boon for regional banks: funding costs would drop (relieving pressure on deposit rates), and any unrealized losses on bond investments would shrink as bond prices recover. It could also stimulate loan demand. However, an abrupt economic downturn that forces rapid rate cuts would likely come with a spike in loan defaults – a less happy scenario for banks.

Another trend to watch is consolidation. The regional banking landscape is ripe for M&A; banks seek to gain scale to spread tech and compliance costs, and weaker banks may seek stronger partners. FSBW itself has been an acquirer (it bought Sound Financial Bancorp in 2023, expanding its footprint) . We wouldn’t be surprised if FSBW makes another acquisition in a year or two, or conversely, if a larger bank eventually eyes FSBW as a takeover candidate given its attractive Seattle-area presence. M&A can unlock value for shareholders (often takeover premiums of 20–30%), though as an acquirer a bank must be careful to not overpay or integrate poorly.

From a dividend perspective, we expect regional bank dividends to remain stable or grow modestly in the coming year. Banks that passed the worst of the 2023 crisis are now resuming increases (many had paused hikes last year). However, regulators and bank boards are likely to be conservative – they remember how swiftly panic can strike. Thus, mid-size banks will probably keep payout ratios moderate and prioritize building capital. Both our bank holdings have sub-40% payout ratios and solid capital, so we are confident in the safety of their dividends. Any future hikes will depend on earnings growth and capital needs. In sum, the financial sector offers selective opportunities for dividend investors. We favor strong, community-focused banks with prudent management (like FSBW) and will continue to avoid the riskier, thinly capitalized names. A measured allocation to regional banks can boost portfolio yield and diversify our sources of dividend income – but it must be paired with diligent monitoring of economic conditions and bank-specific metrics.

IV. Strategic Considerations for Dividend Investors

Building a resilient dividend portfolio requires not just picking the right stocks, but also following sound strategies in managing and growing that portfolio. Here we highlight a few strategic considerations, especially relevant given 2025’s market environment:

A. Reinvest Dividends to Compound Growth

One of the most powerful tools for dividend investors is automatic dividend reinvestment, often through DRIPs (Dividend Reinvestment Plans). By enrolling in a DRIP, each cash dividend you receive is used to buy additional sharesof the same company – including fractional shares – without commissions. This creates a virtuous cycle of compounding: your future dividends grow because you own a bit more stock each time. Over the long run, reinvestment can significantly boost total returns, effectively creating a “snowball” effect . For example, in our portfolio, the quarterly dividends from Apple, Microsoft, etc., are all set to reinvest. The immediate yields on these stocks are low, but reinvesting ensures that every dollar of dividend is put back to work, buying more shares that will themselves generate future dividends. This strategy is especially useful in volatile markets – reinvesting dividends on dips means you are dollar-cost averaging into your positions. Most brokers offer automatic reinvestment at no cost. Caveat: While DRIPs are a generally wise approach, be mindful if a particular holding becomes overweight in your portfolio; blindly reinvesting could exacerbate over-concentration . In such cases, taking dividends in cash and reallocating to other opportunities might be prudent. Overall, though, for a long-term investor who values compounding, dividend reinvestment is a cornerstone strategy that turbocharges your income growth over decades .

B. Prioritize Quality and Sustainability

In the pursuit of income, it’s crucial to focus on the quality and sustainability of dividends, not just the headline yield. A high yield can be a red flag if it’s caused by a distressed stock price or an unsustainable payout ratio. We anchor our portfolio around companies with strong fundamentals, prudent payout policies, and proven commitment to dividends. This means looking at factors like:

- Payout Ratio: What portion of earnings (or free cash flow) is paid as dividends? A moderate payout (say 40–60% for mature companies, lower for growth companies) suggests the dividend has room to grow and a buffer if earnings dip. For instance, Microsoft’s payout is under 35%, leaving ample room for safety and raises. In contrast, if a company pays out 100% of its earnings, any hiccup could force a cut. Both our bank holdings keep payout ratios conservative, which is reassuring given the economic swings banks face.

- Balance Sheet Strength: Companies with strong balance sheets (low debt, plenty of cash) can better sustain dividends during downturns. Apple and Alphabet, with their enormous cash war chests, are exemplars here. We avoid companies that are overly leveraged or carry significant dividend-linked obligations that could strain finances.

- Dividend Track Record: A history of consistent or rising dividends is a positive indicator of management’s commitment. While even great companies can break streaks (often due to extraordinary events), we favor those with a culture of rewarding shareholders. The reason we trusted FSBW was in part due to its 12-year streak of raises – it speaks volumes about management priorities. Similarly, when tech giants like Apple initiated dividends and raised them annually, it signaled a lasting policy change benefiting shareholders.

- Earnings and Cash Flow Stability: Ultimately, dividends are paid with cash, not accounting earnings. We examine whether a company’s business model produces reliable cash flow through cycles. Consumer staples and utilities are classic stable sectors, but even within tech we see stability – e.g., Microsoft’s recurring software revenues or Apple’s services ecosystem. By contrast, companies in highly cyclical or secularly declining industries warrant extra caution with dividends (they may maintain a payout until suddenly they can’t). Ensuring our holdings have durable revenue streams is part of our defense.

By prioritizing quality, we aim to build a portfolio that can weather storms without dividend cuts. This proved crucial in 2023’s choppy market – none of our holdings cut dividends, and several actually raised them, demonstrating resilience. Going forward, we will continue to evaluate the health of our dividend payers rigorously. Chasing yield from a shaky company is a temptation we consciously avoid. Remember, a 3% yield that grows 10% a year will far outdo a 6% yield that never grows or gets cut. Our strategy tilts toward the former: solid companies, growing payouts. It may seem slower at first, but it’s a far more certain path to long-term income success .

C. Maintain Diversification and a Long-Term Perspective

As our portfolio illustrates, we hold a mix of stocks across multiple sectors and risk profiles – from mega-cap tech to community banks. This diversification is by design. It helps reduce reliance on any single sector or company. For example, our tech stocks provide high growth but low yields, whereas our bank stocks provide high current income but are more sensitive to economic cycles. Blending the two (plus other sectors in the future, such as potential additions in healthcare or consumer staples) creates a more balanced income stream. Diversification also means including assets beyond just individual stocks – one could use dividend-focused ETFs or index funds to instantly get broader exposure . In fact, funds like VIG, DGRO, or SCHD are popular dividend-growth ETFs that can complement a stock portfolio . While we primarily hold individual stocks, we acknowledge the benefit of these funds for one-stop diversification.

Equally important is keeping a long-term perspective. Dividend investing is a marathon, not a sprint. There will be periods where our portfolio’s market value fluctuates (sometimes wildly). For instance, the spring tariff-driven correction was a gut check – seeing blue chips temporarily plunge >20% can be uncomfortable. But by focusing on the income and the fundamentals, we avoided panic selling and were rewarded as values recovered. The discipline is to measure progress in terms of rising dividend income, not short-term price gains. All our efforts – reinvesting dividends, selecting quality companies, diversifying – are geared toward maximizing that income stream 5, 10, 20 years from now. History shows that companies with consistent dividend growth tend to be strong businesses that also deliver solid total returns . Thus, by sticking to our strategy, we aim to achieve both growing income and capital appreciation over time.

Patience is vital. Compounding works its magic slowly, then seemingly all at once – much like how a tree grows. We will inevitably face downturns, maybe even recessions, during our investing journey. But with a resilient, well-structured portfolio, we expect to weather the market’s ups and downs while our dividends keep compounding . Our focus remains on the long game: holding and accumulating stakes in excellent businesses that reward us progressively more each year. As long as that thesis holds, day-to-day market noise can be tuned out.

V. Conclusion

June 2025 provided a welcome breather for investors – a chance to appreciate the power of patience and quality amid receding volatility. The U.S. market’s swift rebound from spring’s trade-war scare highlighted a core truth: strong fundamentals ultimately reassert themselves. Our dividend portfolio rode out the turmoil and emerged stronger, with our core holdings continuing to raise or pay dividends on schedule. This month’s calm allowed us to reflect on the resilience of our approach. Each of our companies, from tech giants to regional banks, demonstrated an ability to navigate challenges – be it Apple leveraging its ecosystem to keep growing, or FSBW shoring up deposits and capital in a tougher banking climate.

Importantly, the dividends kept rolling in throughout the volatility. We collected increasing payouts from industry leaders like Microsoft and Alphabet, even as their stock prices bounced around. This reliable income is the bedrock of our strategy – it lets us stay in the game and even buy more shares during dips, rather than being forced out at the worst times. Our portfolio’s dividend income for the first half of 2025 is up double-digits from last year, a direct result of the dividend hikes and reinvestments we’ve implemented. That is tangible progress toward our long-term goals, independent of the market’s mood.

As we enter the second half of 2025, we do so with confidence but not complacency. We recognize that risks (inflation, interest rates, geopolitics) are ever-present. However, we believe our portfolio is well-positioned to handle them. The emphasis on high-quality, financially robust companies means that even if storm clouds gather again, our holdings have the buffers to sustain their dividends. In fact, challenging times often separate the wheat from the chaff – the companies that can continue raising dividends during difficulties are typically those worth sticking with. We have a collection of such companies.

The strategic tweaks we’ve made – for example, adding FS Bancorp to capitalize on an undervalued income opportunity – reflect our ongoing commitment to prudent, proactive management of the portfolio. We’ll remain watchful for any necessary shifts (be it trimming an overvalued position, or diversifying into a new sector) but will avoid knee-jerk reactions. The plan is to stay the course, reinvest our growing dividends, and selectively deploy new capital as opportunities arise. By doing so, we harness the powerful forces of compounding and business growth.

In summary, our dividend portfolio has shown it can weather volatility while continuing to compound income. This resilience is exactly what a dividend strategy is designed for. Month after month, quarter after quarter, we aim to see our income stream rise – a trajectory that can ultimately lead to financial independence or any number of goals. The journey will have its twists, but with each passing update we see the strategy bearing fruit. Here’s to a fruitful second half of 2025, as we keep building a portfolio that not only survives the market’s storms, but thrives through them, paying us more each year for our perseverance .

(Disclosure: This update is for informational purposes and reflects the author’s personal portfolio and opinions. It is not investment advice. All stock prices and yields are as of mid-June 2025.)