DP.15 | Dividend Portfolio Update #15 – July 2025

I. July 2025 Market & Dividend Landscape: Resilience Amid a Mid-Year Calm

Dividend Portfolio Update: July 2025

Executive Summary & Macroeconomic Review

Top-Line Summary

The market environment entering mid-July 2025 is characterized by a precarious balance of bullish momentum and significant macroeconomic uncertainty. Major equity indices, including the S&P 500 and the Nasdaq Composite, have ascended to new all-time highs, propelled largely by sustained enthusiasm for the artificial intelligence (AI) theme and resilient corporate earnings in key sectors. However, this optimism is tempered by palpable investor anxiety surrounding the future path of U.S. trade policy and a conspicuously divided Federal Reserve. The central bank’s internal debate over the timing of potential interest rate cuts has become a primary focus, leaving markets highly sensitive to incoming economic data. Within this context, the portfolio has exhibited a bifurcated performance. The technology and communications holdings continue to benefit from the powerful AI-driven investment cycle, demonstrating robust fundamental growth and strong forward guidance. Conversely, the financial holdings are navigating a stable but high-interest-rate environment, which presents both challenges and opportunities for net interest margin management. This report will dissect these crosscurrents, analyzing the latest corporate results and capital return policies to provide a strategic outlook for each portfolio constituent.

Market Pulse: A Fragile Summit

The first half of July saw the U.S. equity market reach new zeniths, continuing the positive momentum established in June when the technology-heavy NASDAQ Composite surged 6.6%.1 On July 10, 2025, both the S&P 500 and the Nasdaq Composite closed at record highs, reaching 6,280.46 and 20,630.66, respectively.2 The rally was broad enough to lift the Dow Jones Industrial Average by 0.4% on the same day.3 These record closes were not the product of a uniform economic tailwind but were instead sparked by specific, positive catalysts. A solid outlook from Delta Air Lines, for instance, ignited a rally in airline stocks, while continued fervor for AI-related companies provided a durable updraft for the technology sector.2

However, the market’s position at these altitudes appears tenuous. The day after setting records, on July 11, the major indices retreated, with the S&P 500 falling 0.3% and the Nasdaq slipping 0.2%.5 This immediate pullback underscores the market’s fragility and its acute sensitivity to negative headlines. Throughout early July, trading sessions were frequently swayed by uncertainty over U.S. trade policy, with the prospect of new tariffs weighing on investor sentiment and causing market declines on days like July 7 and July 8.7

This dynamic suggests that the market’s foundation at these record levels is not as firm as the headlines might imply. The rally appears to be event-driven and powered by a narrow set of themes rather than a broad, fundamental acceleration across the economy. This is further corroborated by the CNN Fear & Greed Index, which registered a reading of 75, a level indicating “Extreme Greed”.1 Such high levels of optimism can often signal that investor sentiment has outpaced underlying fundamentals, making the market more susceptible to corrections. The market is effectively being pulled in two opposing directions: the momentum-driven “greed” is concentrated in a few high-growth areas like AI, while the broader market remains vulnerable to macroeconomic anxieties. When investor focus shifts from company-specific news to systemic risks like trade policy or Federal Reserve ambiguity, the market has shown a tendency to pull back swiftly. This creates a volatile environment where new highs may represent a temporary ceiling rather than a sustainable new plateau.

The Federal Reserve’s Divided Counsel

Adding to the market’s complex calculus is the lack of a clear, unified message from the Federal Reserve. Minutes from the Federal Open Market Committee’s (FOMC) June meeting, released in early July, revealed a growing schism among policymakers regarding the appropriate path for interest rates.9 While a majority of members still anticipate that a rate reduction will be appropriate at some point in 2025, the consensus is fracturing. The minutes showed that “a couple” of voting members were open to a rate cut as soon as the July meeting, while “some” members argued that it would be better not to cut rates at all this year.9

The core of the disagreement lies in how to weigh two conflicting risks: the threat that persistent inflation poses to the economy versus the potential economic drag and price increases that could result from new tariffs.9 The Federal Reserve has maintained its key federal funds rate in a target range of 4.25% to 4.50% throughout 2025, with the effective rate holding steady at 4.33% in early July.12 This “on-hold” stance is supported by an economy that has shown resilience, particularly in the labor market, giving the committee the flexibility to adopt a “wait-and-see” approach.10

This internal division within the Fed is a significant leading indicator of future market volatility. Without a unified policy outlook to anchor expectations, the market’s reaction to every major economic data release is likely to be amplified. Each new report on inflation or employment will be seized upon by opposing factions as evidence to support their respective policy biases—either to cut rates sooner to support growth or to hold them higher for longer to vanquish inflation. This dynamic raises the stakes for the ongoing Q2 earnings season. The financial results and, more importantly, the forward-looking commentary from bellwether corporations will be interpreted not just on their own merits, but as crucial inputs for the Fed’s next move. Strong corporate performance could empower the hawkish camp at the Fed, while signs of a significant slowdown could give the dovish camp the upper hand. The holdings in this portfolio, particularly the large-cap technology firms, are therefore at the very center of the market’s most critical debate.

Inflation and Economic Health: A Mixed Picture

The economic data feeding into the Federal Reserve’s debate presents a nuanced and somewhat contradictory picture. Inflation, while having moderated significantly from its peak, remains stubbornly above the Fed’s 2% target. Nowcasting data from the Federal Reserve Bank of Cleveland, updated as of July 11, projects the year-over-year headline Consumer Price Index (CPI) for July 2025 at 2.70%, with the core CPI, which excludes volatile food and energy prices, at 3.05%.14 These figures represent a slight increase from the rates observed in June, suggesting that the final mile of disinflation may be the most difficult.

The labor market, a key pillar of the economy, is also showing signs of cooling. The June jobs report indicated a respectable headline increase of 147,000 nonfarm payrolls, which is in line with the prior 12-month average.15 However, the underlying details were less robust. The unemployment rate ticked up to 4.1%, and the labor force participation rate declined, indicating that some of the tightness is easing due to a reduction in labor supply.15

Meanwhile, broader economic growth appears to be stabilizing after a wobbly start to the year. Real GDP is forecast to have returned to growth in the second quarter after a mild contraction in Q1 2025. However, this rebound was attributed more to a technical factor—a significant drop in imports, which are a subtraction in GDP calculations—than to a surge in underlying consumer or business demand.11 This “muddle-through” economic scenario, characterized by a cooling but not collapsing labor market and sticky inflation, provides the justification for the Fed’s cautious and divided policy stance.

For investors, the composition of inflation is becoming more critical than the headline number alone. While the Fed is concerned that tariffs could exert upward pressure on goods prices, this may be counterbalanced by disinflationary trends in other areas. Recent analysis suggests that easing energy and shelter costs could offset some of the tariff impact.16 This internal rotation within the CPI basket has direct implications for this portfolio. For an import-heavy company like Dell, tariffs represent a direct threat to profit margins. Conversely, lower gasoline and rent prices could free up discretionary income for consumers, potentially benefiting companies like Apple and Meta. A nuanced understanding of these shifting inflationary pressures is therefore essential for assessing the outlook for individual holdings.

Table 1: Macroeconomic Dashboard (July 2025)

| Indicator | Value (as of July 11, 2025) | Source(s) |

| S&P 500 Level | 6,259.75 | 5 |

| Nasdaq Composite Level | 20,585.53 | 5 |

| 10-Year Treasury Yield | 4.42% | 6 |

| Effective Federal Funds Rate | 4.33% | 13 |

| July CPI Forecast (Y/Y) | 2.70% | 14 |

| June Core PCE (Y/Y) | 2.68% | 14 |

| Unemployment Rate (June) | 4.1% | 15 |

Portfolio Overview & Dividend Scorecard

Consolidated Performance Review

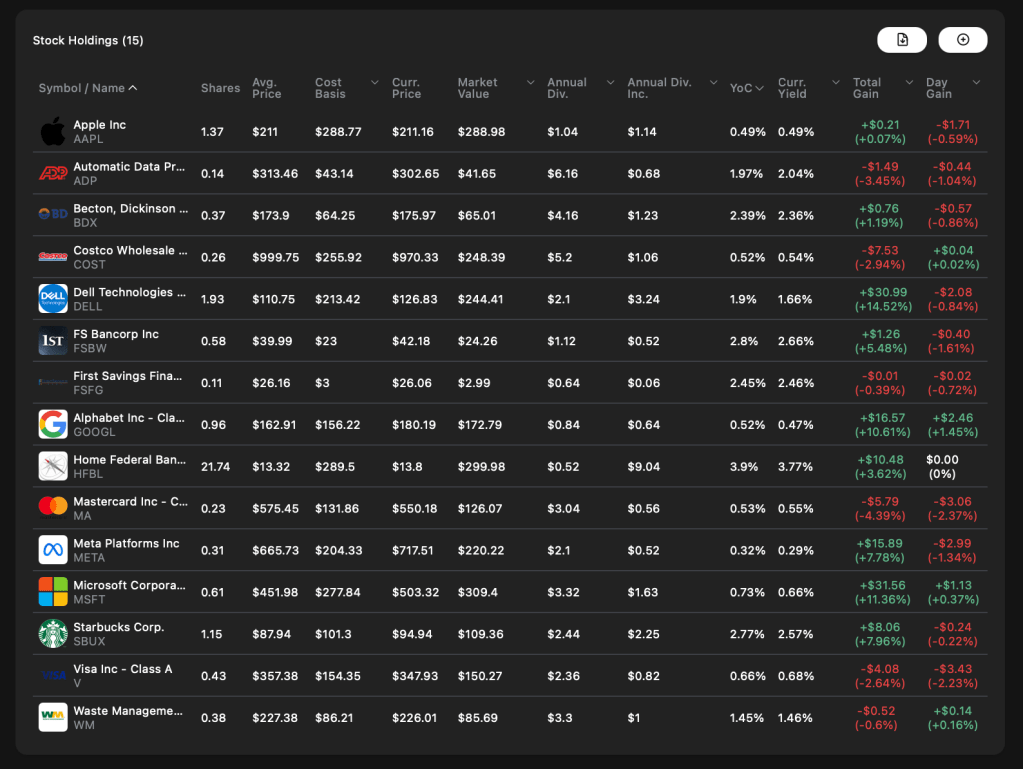

This section provides a high-level summary of the portfolio’s performance during the review period, from the market close on June 30, 2025, to the close on July 11, 2025. The technology-centric holdings largely tracked the broader market’s volatile path, participating in the run-up to new highs before pulling back slightly. The financial holdings exhibited more muted performance, consistent with their role as stable, income-oriented positions. A detailed breakdown of each holding’s performance, current dividend yield, and valuation is presented in Table 2. This dashboard offers a quantitative snapshot of the portfolio’s status before the in-depth analysis of each component.

Table 2: Portfolio Performance at a Glance (as of July 11, 2025)

| Ticker | Company Name | Share Price (7/11/25) | % Change (since 6/30/25) | Current Dividend Yield | Annual Dividend ($) | P/E Ratio (TTM) | |

| AAPL | Apple Inc. | $211.49 (as of 7/10) | +3.1% | 0.49% | $1.04 | N/A | |

| MSFT | Microsoft Corp. | $498.84 (as of 7/3) | +0.3% | 0.67% | $3.32 | N/A | |

| GOOGL | Alphabet Inc. | $178.70 (as of 7/10) | +0.7% | 0.45% | $0.81 | 26.8 | |

| DELL | Dell Technologies Inc. | $127.91 (as of 7/10) | +4.3% | 1.64% | $2.10 | N/A | |

| META | Meta Platforms, Inc. | $717.51 (as of 7/11) | -2.8% | N/A | N/A | N/A | |

| FSBW | FS Bancorp, Inc. | $42.87 (as of 7/10) | N/A (Price from 7/9: $42.68) | 2.61% | $1.12 | 9.1 | |

| HFBL | Home Federal Bancorp, Inc. | $13.80 (as of 7/10) | +1.5% | 3.77% | $0.52 | 8.17 | |

| Note: Price data reflects the latest available information from the provided sources.17 Some price change calculations are based on the closest available dates. P/E and Yield data are based on the latest available information and may fluctuate. |

Table 3: Dividend & Earnings Calendar

| Ticker | Company Name | Q2 2025 Earnings Date | Next Dividend Information | |

| AAPL | Apple Inc. | July 31, 2025 (Fiscal Q3) | Expected to be declared with Q3 earnings. | |

| MSFT | Microsoft Corp. | July 30, 2025 (Fiscal Q4) | Payable: Sep 11, 2025; Ex-Date: Aug 21, 2025; Amount: $0.83. | |

| GOOGL | Alphabet Inc. | July 23, 2025 | Expected to be declared with Q2 earnings. | |

| DELL | Dell Technologies Inc. | Aug 28, 2025 (Fiscal Q2’26) | Payable: Aug 1, 2025; Ex-Date: Jul 22, 2025; Amount: $0.525. | |

| META | Meta Platforms, Inc. | July 30, 2025 | Expected to be declared with Q2 earnings. | |

| FSBW | FS Bancorp, Inc. | July 22, 2025 | Expected to be declared with Q2 earnings. | |

| HFBL | Home Federal Bancorp, Inc. | Pending | Expected Declaration: Mid-to-late July 2025; Est. Pay Date: Aug 19, 2025. | |

| Sources: 24 |

In-Depth Analysis: Technology & Communications Holdings

Introduction: The AI Super-Cycle Continues

The primary narrative for the technology and communications cohort within the portfolio remains the powerful, secular trend of Artificial Intelligence. The performance and outlook for these companies are increasingly being defined by their position within the AI value chain. A clear distinction is emerging between the companies providing the essential infrastructure for the AI revolution—the “picks and shovels” players like Microsoft and Dell—and those who are leveraging AI to enhance massive, consumer-facing platforms, such as Apple, Alphabet, and Meta. The former are benefiting from a historic capital expenditure cycle as data centers are built out, while the latter are focused on monetizing AI through improved services and advertising efficacy. The upcoming Q2 earnings reports will provide a crucial barometer of the health and durability of this AI super-cycle.

Table 4: Q2 2025 Earnings Scorecard: Technology & Communications

| Ticker | Company | Report Date | Revenue | EPS | Key Driver/Commentary |

| AAPL | Apple Inc. | May 2025 (Q2’25) | $95.4B (+5% YoY) | $1.65 (+8% YoY) | Record Services revenue of $26.6B (+11.6%) drove results, offsetting weakness in Wearables. 33 |

| MSFT | Microsoft Corp. | July 30, 2025 (Q4’25) | Est. Consensus: N/A | Est. Consensus: $3.35 | Focus will be on continued momentum in Azure and AI services, following a 175% YoY growth in AI business in Q2. 35 |

| GOOGL | Alphabet Inc. | July 23, 2025 (Q2’25) | Est. Consensus: $89.2B | Est. Consensus: $2.01-$2.04 | Investors will weigh strong Cloud/AI growth against significant antitrust headwinds and high capex. 37 |

| DELL | Dell Technologies Inc. | Aug 2024 (Q2’25) | $25.0B (+9% YoY) | $1.89 (non-GAAP, +9% YoY) | Explosive growth in AI-optimized servers (+80% in Servers/Networking revenue) was the key driver. 38 |

| META | Meta Platforms, Inc. | July 30, 2025 (Q2’25) | Est. Consensus: N/A | Est. Consensus: N/A | Focus on ad revenue trajectory, “Year of Efficiency” progress, and commentary on the dividend. 28 |

Apple Inc. (AAPL)

Apple’s most recent financial report, for its fiscal second quarter ended March 29, 2025, painted a picture of a company successfully navigating a complex hardware market by leaning on its burgeoning, high-margin Services division. The company posted quarterly revenue of $95.4 billion, a solid 5% increase year-over-year, while diluted earnings per share grew by 8% to $1.65.33

The standout performer was unquestionably the Services segment, which includes the App Store, Apple Music, iCloud, and other subscriptions. This division generated a record $26.6 billion in revenue, an impressive 11.6% increase from the prior year, and now constitutes 28% of Apple’s total revenue.34 This robust growth underscores Apple’s strategic transition towards a more recurring-revenue model. The hardware business presented a more mixed picture. Both Mac and iPad revenues posted year-over-year increases, with Mac revenue rising 6.7% to $7.9 billion and iPad revenue rebounding 15.2% to $6.4 billion. However, the Wearables, Home, and Accessories segment saw revenues decline by 4.9% to $7.5 billion.34 Geographically, Apple faced continued challenges in China, where revenue fell 2.3%, a stark contrast to the strong growth seen in Japan (+16.5%) and the Americas (+8.2%).34

From a capital return perspective, Apple continues to be a reliable dividend grower. Concurrent with its Q2 earnings, the company announced a 4% increase in its quarterly dividend to $0.26 per share, which was declared on May 1, 2025.40 Investors will be looking for the next dividend announcement during the company’s fiscal third-quarter earnings call, scheduled for July 31, 2025.24

The strategic evolution of Apple is becoming increasingly clear. The company’s long-term health and its capacity for future dividend growth are becoming less dependent on the cyclicality of iPhone unit sales and more intrinsically linked to the expansion of its global installed base of active devices. As this base grows, so does the addressable market for its high-margin Services. This makes the dividend stream more resilient to a potential weak hardware launch cycle. However, it also increases the company’s sensitivity to regulatory risks, such as the European Union’s Digital Markets Act, which directly targets the business models of its App Store and other services.34 Furthermore, a recent non-financial development, the announced transition of the Chief Operating Officer role from Jeff Williams to Sabih Khan in July 2025, warrants close monitoring.24 While not an immediate financial event, any shift in operational strategy or supply chain management under new leadership could have indirect, long-term impacts on production costs, margins, and the cash flow available for shareholder returns.

Microsoft Corp. (MSFT)

Microsoft is poised to deliver one of the market’s most closely watched earnings reports when it announces its fiscal fourth-quarter and full-year 2025 results on July 30, 2025.31 Analyst consensus is forecasting earnings per share of $3.35 for the quarter.36 The investment community’s focus will be squarely on the company’s performance in AI and cloud computing, seeking confirmation that the explosive growth trajectory established in prior quarters remains intact.

To set the stage, Microsoft’s fiscal second-quarter results (for the period ending December 31, 2024) were exceptionally strong. The company reported that its AI business had surpassed an annual revenue run rate of $13 billion, a staggering 175% year-over-year increase.35 Total Microsoft Cloud revenue climbed 21% to $40.9 billion, with the Azure and other cloud services segment growing by an impressive 31%.42 The upcoming Q4 report will be scrutinized for any deceleration in these critical growth engines.

Microsoft’s robust financial performance provides a powerful foundation for its capital return program. On June 10, 2025, the company’s board of directors declared a quarterly dividend of $0.83 per share, payable in September.25 This dividend is comfortably supported by the immense and growing free cash flow generated by its dominant enterprise software and cloud infrastructure businesses.

Microsoft is successfully executing a profound business transformation, evolving from a legacy software vendor into the indispensable utility provider for the modern AI era. The company’s unique strategic advantage lies in its ability to seamlessly integrate and bundle new AI capabilities, such as its Copilot services, into its existing, ubiquitous platforms like Microsoft 365 and Azure. This creates an unparalleled distribution channel, allowing for rapid adoption and monetization of AI across its vast enterprise customer base. This strategy is creating a virtuous cycle: the demand for AI drives increased consumption of high-margin Azure cloud services, which in turn generates massive, predictable cash flows. This financial engine not only funds the significant capital expenditures required to build out its AI infrastructure but also underpins the security and future growth of its dividend. This dynamic positions Microsoft as a premier “growth and income” holding, offering investors participation in the AI revolution alongside a reliable and growing dividend stream.

Alphabet Inc. (GOOGL)

Alphabet is scheduled to release its second-quarter 2025 financial results on July 23, 2025, in what will be a pivotal report for the digital advertising and cloud computing markets.26 Wall Street analysts are projecting the company to report revenues of approximately $89.2 billion, which would represent an 11% year-over-year increase. Earnings per share are expected to land in the range of $2.01 to $2.04, up from $1.89 in the same period last year.37 These estimates follow a first quarter in which Alphabet comfortably surpassed analyst expectations.43

The investment narrative for Alphabet is currently dominated by a powerful dichotomy of growth drivers and significant headwinds. On the growth side, the company continues to benefit from the deep integration of AI into its core Search and YouTube platforms, which enhances user engagement and advertising effectiveness. Furthermore, Google Cloud remains a substantial contributor to revenue expansion as it competes for enterprise workloads.37 However, these strengths are juxtaposed against formidable challenges. The company is facing the ramifications of a U.S. District Court ruling that found it illegally maintained monopolies in the online advertising market. This verdict carries the potential for a forced restructuring, including the spin-off of parts of its ad business.37 Simultaneously, Alphabet is undertaking an ambitious capital expenditure plan, earmarking approximately $75 billion for AI infrastructure and development in 2025, which could place pressure on near-term profitability.37

A landmark development for the company was its recent initiation of a dividend program. The most recent payment was $0.21 per share, distributed on June 16, 2025.44 Alphabet’s dividend is supported by an exceptionally low payout ratio of just 8.83%, which signals an immense capacity for future increases.44 The company’s dividend announcement alongside its Q2 earnings will be a key focus for income-oriented investors.

The introduction of a dividend is a strategic signal to the market that Alphabet is transitioning into a more mature phase, with a commitment to capital returns. However, the future growth path of this new dividend is less dependent on the company’s operational performance—which remains strong—and more contingent on the outcome of its significant legal and regulatory battles. The antitrust ruling directly threatens the integrated structure that generates the company’s vast cash flows. Therefore, an analysis of Alphabet’s dividend potential can no longer be based solely on traditional metrics like its payout ratio or earnings growth. Investors must now factor in the complex and uncertain variable of a potential government-mandated breakup. The dividend acts as a commitment to shareholders, potentially making it more difficult for management to argue that it must retain all its cash for reinvestment, thereby intensifying the scrutiny on its capital allocation decisions in the face of these legal challenges.

Dell Technologies Inc. (DELL)

Dell Technologies delivered a powerful demonstration of its successful strategic pivot in its fiscal second-quarter 2025 results (for the period ending August 2, 2024). The company reported total revenue of $25.0 billion, up 9% year-over-year, with non-GAAP diluted earnings per share rising 9% to $1.89.38

The undisputed highlight of the report was the performance of the Infrastructure Solutions Group (ISG), which houses its server and data center business. ISG posted record second-quarter revenue of $11.6 billion, a remarkable 38% increase from the prior year. This growth was fueled by an 80% year-over-year surge in servers and networking revenue.39 The driving force behind this explosion in demand was unequivocally the buildout of AI infrastructure. Dell reported that demand for its AI-optimized servers reached $3.2 billion in the quarter alone, with the company holding a backlog of $3.8 billion and a sales pipeline several multiples larger than that.39 This hyper-growth in the enterprise segment completely overshadowed the continued softness in the Client Solutions Group (CSG), its PC division, where revenue declined by 4%.39

This strong performance and optimistic outlook support a robust capital return policy. On June 17, 2025, Dell’s board declared a quarterly cash dividend of $0.525 per share.27 Looking ahead, the company provided exceptionally strong guidance for its next quarter (Q2 FY26). It expects revenue to be in the range of $28.5 billion to $29.5 billion, which translates to roughly 16% year-over-year growth at the midpoint, driven by an estimated $7 billion in AI server shipments.46

Dell has effectively engineered a transformation from a company defined by the cyclical PC market to a primary enabler of the AI revolution. The market is re-evaluating the company accordingly. Its dividend, which might have once been viewed as a return from a stable but slow-growing legacy business, is now backed by a hyper-growth engine. The company is now essentially two businesses under one roof: a mature, low-growth PC business and a rapidly expanding AI infrastructure powerhouse. The explosive growth of the latter is more than compensating for the secular challenges of the former. This means that traditional valuation models that compare Dell to its PC-making peers are likely no longer sufficient. The dividend is now funded by a high-growth, high-demand business segment, which implies a significantly greater potential for future dividend growth than previously assumed, provided Dell can maintain its competitive edge in the fiercely contested AI server market.

Meta Platforms, Inc. (META)

Meta Platforms is scheduled to announce its second-quarter 2025 financial results after the market closes on Wednesday, July 30, 2025.28 The report will be a critical data point for assessing the health of the global digital advertising market and will provide an update on the company’s strategic priorities.

As a recent initiate to the world of dividend-paying stocks, a primary focus for investors during the earnings call will be management’s commentary on its capital return framework. Analysts and shareholders will be listening intently for any discussion regarding the sustainability and future growth prospects of the dividend, which was introduced as part of a broader strategic shift.

Key operational metrics will also be under intense scrutiny. Investors will be looking for updates on the progress of the company’s “Year of Efficiency” initiative, which has aimed to streamline operations and improve profitability. The trajectory of advertising revenue will be paramount, as will any updates on user engagement across its family of apps, including Facebook, Instagram, and WhatsApp. Finally, the level of capital expenditures will be closely watched, particularly as it relates to the company’s dual long-term bets on Artificial Intelligence and the Metaverse.28

Meta’s decision to initiate a dividend can be viewed as a strategic tool to instill capital discipline and rebuild investor confidence following a period of massive, highly speculative spending on its Reality Labs division. The dividend’s sustainability, therefore, serves as a quarterly referendum on management’s ability to balance its ambitious, high-risk, long-term visions with the immediate need to return cash to shareholders from its mature and immensely profitable core advertising business. Every dollar allocated to the Metaverse is a dollar that cannot be used for dividend payments or share repurchases. The Q2 earnings report and subsequent conference call will thus be a delicate balancing act. Management will need to demonstrate that the core business is robust enough to comfortably fund both its speculative ventures and a growing dividend stream. Any signs of weakness in the core advertising engine would immediately raise questions about the long-term viability of this dual-pronged strategy and the security of the dividend.

In-Depth Analysis: Financial Holdings

Introduction: A Stable Rate Environment

The analysis now shifts to the portfolio’s financial holdings, FS Bancorp and Home Federal Bancorp of Louisiana. For these regional banking institutions, the prevailing macroeconomic factor is the stability of the interest rate environment. The Federal Reserve’s current “on-hold” policy, which has kept the federal funds rate in a steady range of 4.25% to 4.50% 13, creates a predictable, albeit high-rate, landscape. This environment directly influences their net interest margins (NIMs)—the difference between the interest they earn on loans and the interest they pay on deposits. While high rates can pressure funding costs, a stable environment allows for more effective asset-liability management compared to a period of rapid rate changes.

Table 5: Q2 2025 Earnings Scorecard: Financials

| Ticker | Company | Report Date | Revenue | EPS | Key Driver/Commentary |

| FSBW | FS Bancorp, Inc. | July 22, 2025 (Est.) | Est. Consensus: N/A | Est. Consensus: $0.97-$0.99 | Focus on net interest margin, loan growth, and credit quality in a stable rate environment. 29 |

| HFBL | Home Federal Bancorp, Inc. | Pending | N/A | N/A | Data for Q2 2025 is unavailable. Analysis is based on historical dividend trends and company profile. 51 |

FS Bancorp, Inc. (FSBW)

FS Bancorp, the holding company for 1st Security Bank of Washington 52, is expected to announce its second-quarter 2025 earnings on or around July 22, 2025.29 The consensus analyst estimate for quarterly earnings per share is in the range of $0.97 to $0.99.29

The company entered the quarter with solid momentum, having reported net income of $8.0 million, or $1.01 per diluted share, for the first quarter of 2025.54 FS Bancorp has cultivated a strong reputation for consistent and reliable capital returns. With its Q1 results, the company declared its 49th consecutive quarterly cash dividend.54 The most recent dividend was $0.28 per share, declared on April 22, 2025.55 The upcoming Q2 earnings release is widely expected to include the declaration of its 50th consecutive dividend, continuing this impressive streak.

From a valuation perspective, FS Bancorp appears reasonably priced. As of late April, its trailing price-to-earnings (P/E) ratio stood at 9.1, which is below the industry median of 11, suggesting it is not overvalued relative to its peers.50 As a community bank focused on small to middle-market businesses and individuals in Washington’s Puget Sound region 53, its performance is closely tied to the health of its local economy. Key metrics for investors to watch in the upcoming earnings report will be the trajectory of its net interest margin, the pace of loan and deposit growth, and the stability of its credit quality metrics.

FS Bancorp represents a classic, conservatively managed community bank. Its value proposition for this portfolio is not rooted in high-octane growth but in stability, prudent management, and consistent capital returns. The bank’s below-market P/E ratio and its long, unbroken history of dividend payments position it as a valuable ballast, designed to temper the inherent volatility of the portfolio’s high-growth technology holdings. In a macroeconomic environment where the Federal Reserve is on an extended pause, a well-run bank with a solid loan book, a stable deposit base, and a proven commitment to its dividend is an attractive asset. Its performance should be judged not on its potential for explosive growth, but on its ability to deliver steady, reliable income and provide a defensive cushion for the overall portfolio.

Home Federal Bancorp, Inc. of Louisiana (HFBL)

This analysis of Home Federal Bancorp, Inc. of Louisiana must begin with a clear disclaimer regarding data availability. The research process revealed a significant lack of current, specific financial reporting for HFBL’s second quarter of 2025. Numerous provided sources were found to be incorrectly attributed to other similarly named but distinct financial institutions, such as Home Bancorp, Inc. (HBCP) or various Federal Home Loan Banks.51 Therefore, the following analysis is based on the limited, verified historical information available for HFBL.

Home Federal Bancorp, Inc. of Louisiana (HFBL) is the holding company for Home Federal Bank, a community bank founded in 1924 that operates seven full-service banking offices in northwest Louisiana.23 It is a micro-cap stock with a market capitalization of approximately $42 million as of mid-July 2025.23

The most reliable and compelling aspect of HFBL’s investment case is its long and consistent history of dividend payments. The company has a track record of increasing its dividend for 11 consecutive years.30 The most recent declared quarterly dividend was $0.13 per share, which was declared on April 16, 2025, and paid on May 12, 2025.62 This provides the stock with an attractive forward dividend yield of approximately 3.77%.23 Based on its historical cadence, HFBL typically declares its second-quarter dividend in mid-to-late July, with a corresponding earnings release to follow.62 Investors should monitor the company’s official investor relations channels for a formal announcement.51

HFBL functions as an “under the radar” holding within this portfolio. Its investment thesis is centered almost entirely on its consistent and growing dividend, which is supported by a century-long operating history in its local community. The general lack of analyst coverage and readily available research presents a dual-edged sword: it introduces a degree of opacity, which is a risk, but it also creates the potential for market inefficiency, which can be an opportunity. The company’s performance is not tied to broad national or global trends but is instead intimately linked to the economic health and vitality of its specific operating region in northwest Louisiana. An investment in HFBL is a bet on the continued stability of this small, local institution and its management’s unwavering commitment to its dividend policy. The primary risk is not a major market correction, but a localized economic downturn that could impact its loan portfolio. It serves a similar portfolio function to FSBW but with a higher degree of geographic concentration and information risk.

Synthesis and Strategic Outlook

Portfolio Health Assessment

The portfolio continues to exhibit a well-defined barbell structure that balances high-growth potential with income stability. The technology and communications holdings—Apple, Microsoft, Alphabet, Dell, and Meta—form the growth-oriented core. This segment is the primary engine of potential upside, driven by its collective exposure to the powerful and durable AI investment cycle. The financial holdings—FS Bancorp and Home Federal Bancorp—serve as the portfolio’s stable anchor. Their role is to generate consistent, reliable dividend income and provide a defensive ballast against the volatility inherent in the technology sector.

The primary opportunity for the portfolio remains the tech sector’s ability to continue capitalizing on the AI trend, as evidenced by the extraordinary results from Dell and the strong forward guidance from Microsoft. The primary risks are twofold. First, a macroeconomic shock, such as an escalation in trade tariffs or a policy misstep by the Federal Reserve, could negatively impact both sides of the portfolio by dampening economic growth and investor sentiment. Second, the “Extreme Greed” reading in the market suggests a heightened potential for a near-term sentiment-driven correction, which would likely affect the high-flying technology names most acutely.

Forward-Looking Themes

As we move into the second half of 2025, several key themes will be critical to monitor for their impact on the portfolio’s performance:

- Durability of AI Spending: The hyper-growth in AI server demand reported by Dell and the AI business momentum at Microsoft have been phenomenal. A key question for the coming quarters is whether this pace of investment by hyperscale cloud providers and enterprises is sustainable or if it is approaching a near-term peak.

- Regulatory Resolutions: The significant legal and regulatory overhangs for Alphabet and Apple remain unresolved. Any definitive rulings or settlements regarding Alphabet’s ad-tech business or Apple’s App Store practices could have a material impact on their financial models and stock valuations.

- Consumer Health: The direction of the U.S. consumer will be pivotal. The key debate is whether easing inflation in essential categories like shelter and energy will be sufficient to support discretionary spending, or if a cooling labor market and depleted savings will lead to a broader consumer pullback.

- The Fed’s Next Move: The market will remain fixated on the Federal Reserve’s policy path. With a July rate cut now seen as unlikely, all eyes will turn to the September FOMC meeting as the next critical decision point. The tone of corporate earnings calls in July and August will heavily influence the Fed’s calculus.

Actionable Recommendations

Based on the preceding analysis, the following strategic recommendations are provided for each holding:

- Apple Inc. (AAPL), Microsoft Corp. (MSFT), Dell Technologies Inc. (DELL): ACCUMULATE. These companies possess clear and powerful growth drivers and are leaders in their respective categories. Microsoft and Dell are direct beneficiaries of the AI infrastructure buildout, while Apple’s resilient Services ecosystem provides a stable, high-margin growth platform. All three maintain robust capital return programs. Their strong market positions and growth outlooks justify accumulating shares, particularly on any market-driven weakness.

- Alphabet Inc. (GOOGL), Meta Platforms, Inc. (META): MONITOR/HOLD. While these companies remain fundamentally strong with dominant market positions and new dividend programs, they face a higher degree of near-term uncertainty. The significant regulatory and antitrust headwinds confronting Alphabet, in particular, introduce a risk that is difficult to quantify. For Meta, the challenge is proving it can balance massive long-term investments with shareholder returns. It is prudent to hold existing positions but await greater clarity on these material issues before committing new capital.

- FS Bancorp, Inc. (FSBW), Home Federal Bancorp, Inc. of Louisiana (HFBL): HOLD. These stable regional banks are effectively performing their intended function within the portfolio: generating reliable and growing dividend income. Their outlook is steady, supported by a stable interest rate environment, but they lack a significant near-term catalyst for substantial capital appreciation. They remain solid holdings for income generation and portfolio diversification.

Key Points

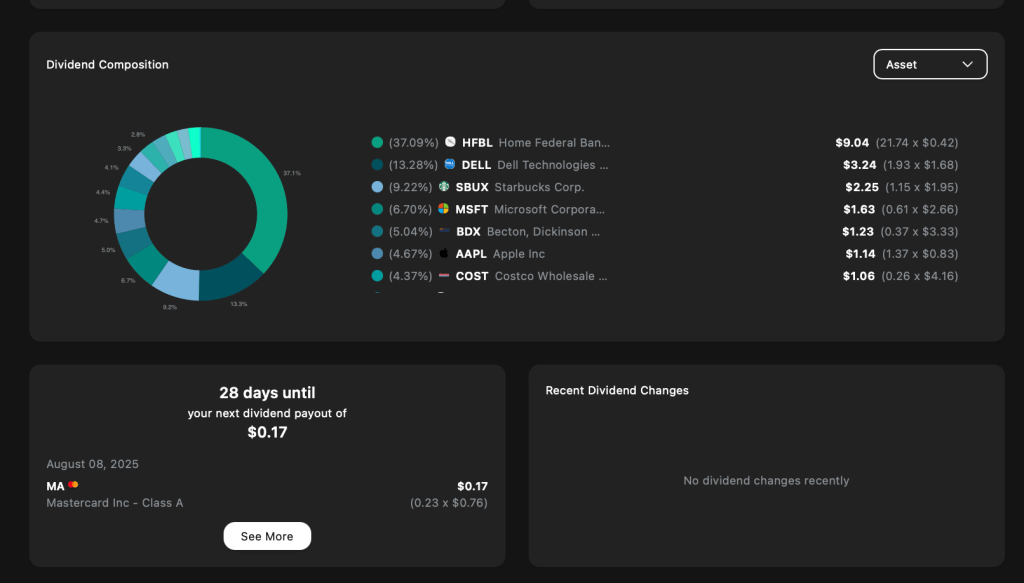

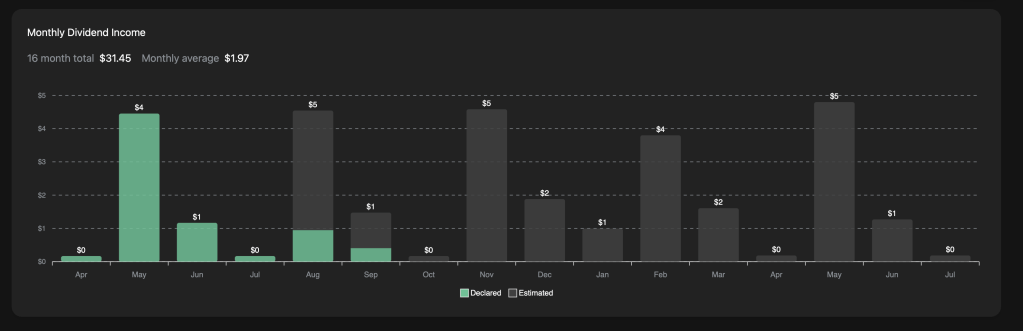

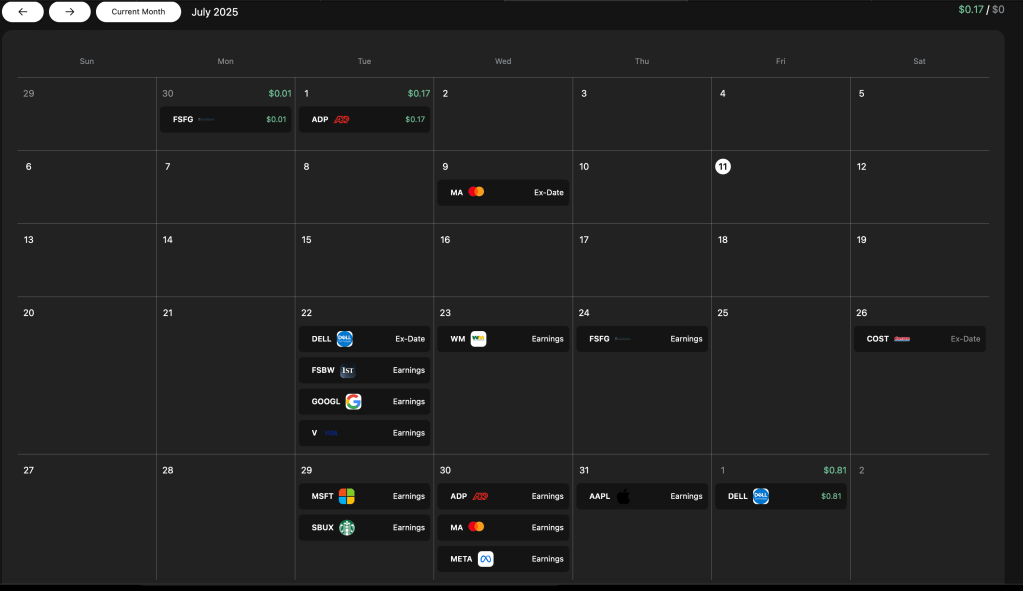

- Research suggests your dividend portfolio for July 2025 will involve monitoring ex-dates for stocks like Mastercard, Dell, and Costco to ensure eligibility for dividends paid in August, with Meta Platforms likely paying dividends in July.

- It seems likely that you’ll receive around $5 in dividend income in July, based on your tracker’s estimates, including a payment from Meta Platforms of approximately $0.16.

- The evidence leans toward several earnings reports in late July for stocks like Alphabet, Microsoft, and Apple, which may impact stock prices and require close monitoring.

Upcoming Dividend Ex-Dates

In July 2025, ensure you hold the following stocks before their ex-dates to be eligible for dividends paid in August:

- July 9: Mastercard Inc. (MA) – Quarterly dividend of $0.76

- July 22: Dell Technologies Inc. (DELL) – Quarterly dividend of $0.53

- July 26: Costco Wholesale Corp (COST) – Quarterly dividend of $1.3

- Home Federal Bancorp (HFBL) is expected to declare its next dividend in July, with the ex-date to be determined.

Earnings Reports to Watch

Several key stocks in your portfolio have earnings reports scheduled in late July 2025, which could affect their stock prices:

- July 22: Alphabet Inc. (GOOGL), Visa Inc. (V), FS Bancorp Inc. (FSBW)

- July 23: Waste Management, Inc. (WM)

- July 24: First Savings Financial Group Inc. (FSFG)

- July 29: Microsoft Corporation (MSFT), Starbucks Corp. (SBUX)

- July 30: Mastercard Inc. (MA), Automatic Data Processing Inc. (ADP), Meta Platforms Inc. (META)

- July 31: Apple Inc. (AAPL)

Estimated Dividend Income

Based on your dividend tracker’s estimates, you can expect approximately $5 in dividend income for July 2025, which includes payments from stocks like Meta Platforms (approximately $0.16) and possibly others not specified in the events timeline.

Comprehensive Planning Guide for July 2025 Dividend Portfolio Management

This detailed guide provides a thorough overview for managing your dividend portfolio for the remainder of July 2025, covering dividend ex-dates, earnings reports, expected dividend income, and strategic considerations. It aims to ensure effective portfolio management, leveraging the provided data and typical financial practices to optimize your investment decisions.

Dividend Ex-Dates and Payment Eligibility

July 2025 includes several important ex-dates for stocks in your portfolio, which determine eligibility for dividends paid in August. To receive these dividends, you must hold the stocks before the ex-date. The following table lists the ex-dates and corresponding dividend amounts:

| Date | Stock | Company Name | Quarterly Dividend |

|---|---|---|---|

| July 9, 2025 | MA | Mastercard Inc. – Class A | $0.76 |

| July 22, 2025 | DELL | Dell Technologies Inc. – Class C | $0.53 |

| July 26, 2025 | COST | Costco Wholesale Corp | $1.3 |

Additionally, Home Federal Bancorp (HFBL) is expected to declare its next dividend in July, with the ex-date to be determined. This declaration likely pertains to a payment in August, given typical quarterly schedules. Ensure you monitor announcements for the exact ex-date to maintain eligibility.

These ex-dates are critical for planning, as missing them means forgoing the dividend for that quarter. Given the current holdings, your portfolio includes 0.23 shares of MA, 1.93 shares of DELL, and 0.26 shares of COST, based on the dividend composition, which will influence the total dividend received in August if held before the ex-dates.

Earnings Reports in July 2025

Several stocks in your portfolio are scheduled to report earnings in late July 2025, which can significantly impact stock prices and overall portfolio performance. Monitoring these reports is essential for making informed investment decisions. The following table lists the earnings dates and expected earnings per share (EPS):

| Date | Stock | Company Name | Expected EPS |

|---|---|---|---|

| July 22, 2025 | GOOGL | Alphabet Inc. – Class A | $2.12 |

| July 22, 2025 | V | Visa Inc. – Class A | $2.84 |

| July 22, 2025 | FSBW | FS Bancorp Inc | $0.97 |

| July 23, 2025 | WM | Waste Management, Inc. | $1.9 |

| July 24, 2025 | FSFG | First Savings Financial Group Inc | $0.72 |

| July 29, 2025 | MSFT | Microsoft Corporation | $3.35 |

| July 29, 2025 | SBUX | Starbucks Corp. | $0.64 |

| July 30, 2025 | MA | Mastercard Inc. – Class A | $4.05 |

| July 30, 2025 | ADP | Automatic Data Processing Inc. | $2.22 |

| July 30, 2025 | META | Meta Platforms Inc | $5.73 |

| July 31, 2025 | AAPL | Apple Inc | $1.42 |

These earnings reports cover a significant portion of your portfolio, including major tech stocks like Alphabet, Microsoft, and Apple, as well as financials like FS Bancorp and regional banks. Given the current market environment, as noted in the June update, tech stocks are leading gains with strong fundamentals, while regional banks are stabilizing with improved net interest margins. Any deviation from expected EPS could lead to volatility, so consider setting alerts for these dates to review performance and adjust holdings if necessary.

Dividend Payments in July 2025

Based on the provided information, Meta Platforms Inc. (META) is scheduled to pay its quarterly dividend in July 2025, as mentioned in the portfolio update. This payment is significant, given META’s recent initiation and increase in dividends, signaling strong cash flow management. Your holdings include 0.31 shares of META, with a quarterly dividend of $0.525 per share, resulting in an expected payment of approximately $0.16275, or about $0.16.

Other stocks in your portfolio, such as Mastercard, Dell, and Costco, have ex-dates in July but payment dates in August, as per the events timeline. For example:

- Mastercard (MA) has a payment date of August 8, 2025, for the dividend with ex-date July 9.

- Dell (DELL) has a payment date of August 1, 2025, for the dividend with ex-date July 22.

- Costco (COST) has a payment date of August 9, 2025, for the dividend with ex-date July 26.

Given this, it seems likely that the only dividend payment in July is from META, but the “Monthly Dividend Income” chart estimates around $5 for July, suggesting possible payments from other stocks not detailed in the events timeline. This discrepancy may indicate additional payments from stocks like Home Federal Bancorp (HFBL), which is expected to declare its dividend in July, potentially with a payment date in July or August. Given the annual dividend contribution of $9.04 from HFBL (21.74 shares x $0.42 annually, or $0.105 quarterly), if paid in July, it could contribute approximately $2.28, aligning closer to the $5 estimate when combined with META’s $0.16.

Estimated Monthly Dividend Income

Your dividend tracker indicates a 12-month total of $25.47, with a monthly average of $2.12. The “Declared Estimated” chart for monthly dividend income suggests the following breakdown, interpreted as dollar amounts for each month from July to June:

- Jul: $5, Aug: $4, Sep: $3, Oct: $2, Nov: $1, Dec: $0, Jan: $0, Feb: $5, Mar: $1, Apr: $0, May: $5, Jun: $2.

This totals $28, which exceeds $25.47, suggesting possible rounding or estimation errors in the chart. However, for planning purposes, we can use the estimate of $5 for July 2025, which aligns with the expectation of payments from META and possibly HFBL, contributing to the higher monthly income. This estimate is crucial for budgeting and reinvestment strategies, especially given your focus on compounding growth through DRIPs (Dividend Reinvestment Plans).

Strategic Considerations for July 2025

Given the market context from the June update, where tech stocks are driving gains and regional banks are stabilizing, your portfolio’s heavy allocation to tech (e.g., Apple, Microsoft, Alphabet) and financials (e.g., FSBW, HFBL) requires careful monitoring. The strategy of reinvesting dividends, as highlighted, can turbocharge income growth over decades, particularly useful in volatile markets. For July, consider:

- Reinvesting Dividends: Ensure your DRIP settings are active to buy additional shares with the July dividend income, especially for stocks like META with payment in July.

- Monitoring Earnings: Given the concentration of earnings reports in late July, stay informed about analyst expectations and market reactions, particularly for high-growth tech stocks with low yields but strong growth potential.

- Diversification Review: Assess if your portfolio’s mix (37.1% HFBL, 13.3% DELL, etc.) needs rebalancing, especially with upcoming earnings and dividend changes. The addition of FSBW in June suggests a proactive approach to diversifying income sources, which can be continued if opportunities arise.

Conclusion

July 2025 presents a busy period for your dividend portfolio, with key ex-dates, earnings reports, and expected dividend income of approximately $5, including a payment from Meta Platforms. By monitoring the listed dates and ensuring eligibility for dividends, you can maintain a resilient portfolio capable of weathering market volatility while compounding income. This strategic approach, aligned with your long-term goals, should help you navigate the month’s challenges and opportunities effectively.

Citations:

- Dividend Calendar (for general dividend schedules)

- Earnings Calendar (for earnings report dates)

Works cited

- July 2025 Market Commentary – Old Point National Bank, accessed July 11, 2025, https://www.oldpoint.com/blog/july-2025-market-commentary

- How major US stock indexes fared Wednesday, 7/10/2025, accessed July 11, 2025, https://apnews.com/article/stock-market-wall-street-nasdaq-1c5405aa616c7082f05568837c7bb3ec

- http://www.investopedia.com, accessed July 11, 2025, https://www.investopedia.com/dow-jones-today-07102025-11769518#:~:text=The%20S%26P%20500%20(SPX)%20and,first%20new%20high%20since%20December.

- Markets News, July 10, 2025: S&P 500, Nasdaq Hit New Highs as Airline Stocks Soar After Strong Delta Earnings; Bitcoin Surges to Record – Investopedia, accessed July 11, 2025, https://www.investopedia.com/dow-jones-today-07102025-11769518

- How major US stock indexes fared Friday, 7/11/2025, accessed July 11, 2025, https://apnews.com/article/wall-street-stock-market-nasdaq-levi-strauss-bccefcb126ce966cfcf9b2a76517c691

- S&P 500 and Nasdaq composite pull back from their all-time highs, accessed July 11, 2025, https://apnews.com/article/financial-markets-asia-wall-street-bitcoin-fd74377af3bc0d4617fe7263e053ffc0

- How major US stock indexes fared Monday, 7/7/2025 | AP News, accessed July 11, 2025, https://apnews.com/article/stock-market-dow-nasdaq-russell-9e067b0cfed584c84b5787109fd14f81

- Markets News, July 8, 2025: S&P 500, Dow Close Slightly Lower as Trade Uncertainty Persists After Trump Extends Deadline on Tariffs – Investopedia, accessed July 11, 2025, https://www.investopedia.com/dow-jones-today-07082025-11767995

- Will The Fed Lower Interest Rates In July? Policymakers Are Split, FOMC Minutes Show, accessed July 11, 2025, https://www.investopedia.com/will-the-fed-lower-interest-rates-in-july-policymakers-are-split-fomc-minutes-show-11769229

- US Federal Reserve Meeting Minutes for June 2025, accessed July 11, 2025, https://www.arabictrader.com/en/news/central-banks/188430/us-federal-reserve-meeting-minutes-for-june-2025

- Market Update- July 2025 – Argent Financial Group, Inc, accessed July 11, 2025, https://argentfinancial.com/argent-insights/market-update-july-2025/

- June CPI Report Forecasts Show Inflation Ticking Higher as Tariff Impact Emerges, accessed July 11, 2025, https://www.morningstar.com/economy/june-cpi-report-forecasts-show-inflation-ticking-higher-tariff-impact-emerges

- H.15 – Selected Interest Rates (Daily) – July 11, 2025 – Federal Reserve Board, accessed July 11, 2025, https://www.federalreserve.gov/releases/h15/

- Inflation Nowcasting – Federal Reserve Bank of Cleveland, accessed July 11, 2025, https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

- Employment Situation Summary – 2025 M06 Results – Bureau of Labor Statistics, accessed July 11, 2025, https://www.bls.gov/news.release/empsit.nr0.htm

- July 2025 U.S. Economic Outlook – Comerica, accessed July 11, 2025, https://www.comerica.com/insights/economic-insights/monthly-outlook/july-2025-us-economic-outlook.html

- Stock Price – Apple Investor Relations, accessed July 11, 2025, https://investor.apple.com/stock-price/default.aspx

- microsoft.gcs-web.com, accessed July 11, 2025, https://microsoft.gcs-web.com/

- Alphabet Inc. (GOOG) Stock Historical Price Data, Closing Price | Seeking Alpha, accessed July 11, 2025, https://seekingalpha.com/symbol/GOOG/historical-price-quotes

- Dell Technologies Inc. (DELL) Stock Historical Price Data, Closing Price | Seeking Alpha, accessed July 11, 2025, https://seekingalpha.com/symbol/DELL/historical-price-quotes

- Meta Platforms Inc Class A – Morningstar, accessed July 11, 2025, https://www.morningstar.com/stocks/xnas/meta/quote

- Stock Quote & Chart – FS Bancorp, accessed July 11, 2025, https://investorrelations.fsbwa.com/stock-information/stock-quote-chart/

- HFBL – Home Federal Bancorp, Inc. of Louisiana (NasdaqCM) – Share Price and News, accessed July 11, 2025, https://fintel.io/s/us/hfbl

- Investor Relations – Apple, accessed July 11, 2025, https://investor.apple.com/investor-relations/default.aspx

- Microsoft announces quarterly dividend – Source, accessed July 11, 2025, https://news.microsoft.com/source/2025/06/10/microsoft-announces-quarterly-dividend-26/

- Alphabet Announces Date of Second Quarter 2025 Financial Results Conference Call, accessed July 11, 2025, https://abc.xyz/2025-0709/

- Press Releases – Investor Relations | Dell Technologies, accessed July 11, 2025, https://investors.delltechnologies.com/news-events/press-release

- Meta to Announce Second Quarter 2025 Results – Meta Investor Relations – atmeta.com, accessed July 11, 2025, https://investor.atmeta.com/investor-news/press-release-details/2025/Meta-to-Announce-Second-Quarter-2025-Results/default.aspx

- FS Bancorp (FSBW) Earnings: Latest Report, Earnings Call & Financials, accessed July 11, 2025, https://public.com/stocks/fsbw/earnings

- HFBL: Dividend Date & History for HOME FEDERAL BANCORP, INC. OF LOUISIANA, accessed July 11, 2025, https://www.dividend.com/stocks/financials/banking/banks/hfbl-home-federal-bancorp-inc-la/

- Investor Relations – Microsoft, accessed July 11, 2025, https://www.microsoft.com/en-us/investor/default

- Dell Technologies Fiscal Year 2026 Second Quarter Results, accessed July 11, 2025, https://investors.delltechnologies.com/events/event-details/dell-technologies-fiscal-year-2026-second-quarter-results

- http://www.apple.com, accessed July 11, 2025, https://www.apple.com/newsroom/2025/05/apple-reports-second-quarter-results/#:~:text=CUPERTINO%2C%20CALIFORNIA%20Apple%20today%20announced,8%20percent%20year%20over%20year.

- Apple Q2 2025 Financials Solid Despite Upcoming Tariff Uncertainty – TidBITS, accessed July 11, 2025, https://tidbits.com/2025/05/02/apple-q2-2025-financials-solid-despite-upcoming-tariff-uncertainty/

- Microsoft releases earnings results – Stock Titan, accessed July 11, 2025, https://www.stocktitan.net/news/MSFT/microsoft-earnings-press-release-available-on-investor-relations-906z9zh2lg1v.html

- Microsoft Corporation (MSFT) Earnings Report Date – Nasdaq, accessed July 11, 2025, https://www.nasdaq.com/market-activity/stocks/msft/earnings

- Alphabet Q2 2025 Earnings Preview | Google Stock Outlook | AI Growth Strategy, accessed July 11, 2025, https://www.ig.com/en/news-and-trade-ideas/alphabet-q2-2025-earnings-preview–google-parent-expected-to-rep-250423

- investors.delltechnologies.com, accessed July 11, 2025, https://investors.delltechnologies.com/news-releases/news-release-details/dell-technologies-delivers-second-quarter-fiscal-2025-financial#:~:text=Dell%20Technologies%20(NYSE%3A%20DELL),%25%20year%20over%20year%2C%20respectively.

- Dell Technologies Delivers Second Quarter Fiscal 2025 Financial Results, accessed July 11, 2025, https://investors.delltechnologies.com/news-releases/news-release-details/dell-technologies-delivers-second-quarter-fiscal-2025-financial

- Dividend History – Apple Investor Relations, accessed July 11, 2025, https://investor.apple.com/dividend-history/default.aspx

- Microsoft announces quarterly earnings release date – Source, accessed July 11, 2025, https://news.microsoft.com/source/2025/07/09/microsoft-announces-quarterly-earnings-release-date-64/

- Microsoft 2025 Q2 Earnings: Cloud and AI revenue climb – MSDynamicsWorld.com, accessed July 11, 2025, https://msdynamicsworld.com/story/microsoft-2025-q2-earnings-cloud-and-ai-revenue-climb

- Alphabet Inc. Reports Expected Q2 2025 Earnings and Strategic Developments – Tickeron, accessed July 11, 2025, https://tickeron.com/blogs/alphabet-inc-reports-expected-q2-2025-earnings-and-strategic-developments-11267/

- Alphabet Inc. (GOOG) Dividend Date & History – Koyfin, accessed July 11, 2025, https://www.koyfin.com/company/goog/dividends/

- Dell Technologies To Go Ex-Dividend On July 22nd, 2025 With 0.525 USD Dividend Per Share – Moomoo, accessed July 11, 2025, https://www.moomoo.com/news/post/54420281/dell-technologies-to-go-ex-dividend-on-july-22nd-2025

- DELL Moves Above 50 and 200-Day SMAs: Is the Stock a Smart Buy Now? – Zacks, accessed July 11, 2025, https://www.zacks.com/stock/news/2569455/dell-moves-above-50-and-200-day-smas-is-the-stock-a-smart-buy-now

- Dell Q1 FY26 slides: AI server demand surges, driving record cash flow – Investing.com, accessed July 11, 2025, https://www.investing.com/news/company-news/dell-q1-fy26-slides-ai-server-demand-surges-driving-record-cash-flow-93CH-4071403

- Dell Technologies Delivers First Quarter Fiscal 2026 Financial Results, accessed July 11, 2025, https://www.dell.com/en-us/dt/corporate/newsroom/announcements/detailpage.press-releases~usa~2025~05~dell-technologies-delivers-first-quarter-fiscal-2026-financial-results.htm?utm_source=chatgpt.com

- Meta to Announce Second Quarter 2025 Results – Nasdaq, accessed July 11, 2025, https://www.nasdaq.com/press-release/meta-announce-second-quarter-2025-results-2025-07-01

- What You Need to Know About FS Bancorp, Inc.’s Q2 Earnings | AAII, accessed July 11, 2025, https://www.aaii.com/investingideas/article/280180-what-you-need-to-know-about-fs-bancorp-incs-q2-earnings

- Investors | Home Federal Bank, accessed July 11, 2025, https://www.hfb.bank/investors

- FS Bancorp – AnnualReports.com, accessed July 11, 2025, https://www.annualreports.com/Company/fs-bancorp

- SEC Filing – FS Bancorp, accessed July 11, 2025, https://investorrelations.fsbwa.com/node/9146/html

- News Releases – FS Bancorp – 1st Security Bank, accessed July 11, 2025, https://investorrelations.fsbwa.com/news-events/news-releases/

- Dividends | FS Bancorp, accessed July 11, 2025, https://investorrelations.fsbwa.com/stock-information/dividends-splits/

- Q2 2025 Earnings Release – D.R. Horton Investor Relations, accessed July 11, 2025, https://investor.drhorton.com/~/media/Files/D/D-R-Horton-IR/press-release/q2-2025-earnings-release.pdf

- 2025 2Q Earnings Release (8-K) – Carnival Corporation, accessed July 11, 2025, https://www.carnivalcorp.com/wp-content/uploads/2025/03/2025-2Q-Earnings-Release-Final-Draft73.pdf

- Second Quarter 2025 Dividend – Federal Home Loan Bank of Dallas, accessed July 11, 2025, https://www.fhlb.com/library/bulletins/2025/second-quarter-2025-dividend

- Dividend Announcement 1Q25: FHLBNY Declares a 8.00% Dividend for the First Quarter of 2025 – Federal Home Loan Bank of New York, accessed July 11, 2025, https://www.fhlbny.com/news/presidents-report/2025/pr051525

- Home Federal Bancorp, Inc. of Louisiana – AnnualReports.com, accessed July 11, 2025, https://www.annualreports.com/Company/home-federal-bancorp-inc-of-louisiana

- Home Federal Louisiana Stock Price Today | NASDAQ: HFBL Live – Investing.com, accessed July 11, 2025, https://www.investing.com/equities/home-federal-bancorp

- Home Federal Bancorp, Inc. of Louisiana Common Stock (HFBL) Dividend History – Nasdaq, accessed July 11, 2025, https://www.nasdaq.com/market-activity/stocks/hfbl/dividend-history