Aug ’25 | (AWR)

American States Water Company (AWR): Dividend Investing Rooted in the Elemental Necessity of Water

Understanding $AWR: Seven Decades of Dividend Growth Built on Life’s Fundamental Resource

By Zachary Gedal | ~30-minute read

Part 1: Company Overview and Philosophy

Introduction

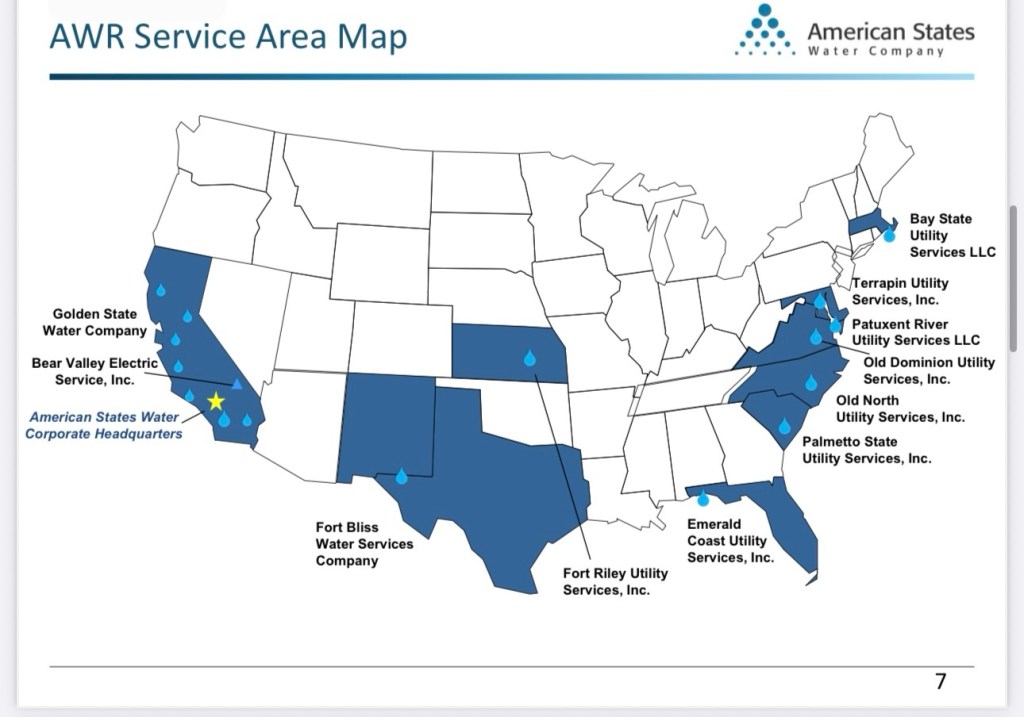

American States Water Company (NYSE: AWR) stands as a testament to the enduring power of essential services. Founded in 1929, AWR provides water, wastewater, and electric services to customers primarily in California. Yet, it’s the company’s water utility business and unparalleled dividend history—over 70 consecutive years of dividend increases—that truly set AWR apart. In a world of uncertainty, from market swings to technological upheavals, AWR’s commitment to delivering a fundamental necessity—clean water—anchors its steady, reliable returns to investors. For those focusing on dividends, AWR isn’t just another stock; it’s a generational cornerstone that embodies stability, responsibility, and a long-term approach that few companies can match. Sprinkles gently nourishing lawns, children sipping from taps, and families starting their day with the simple act of turning on the faucet. Behind that everyday scene stands AWR, ensuring that a vital, life-sustaining resource is delivered safely and efficiently. Owning AWR shares means stepping into this continuity, where your dividends reflect not just corporate performance, but the unwavering necessity of water in human life.

Founding and Early History

AWR’s origins trace back nearly a century, born during an era when reliable water systems were still a growing luxury. Over decades, the company methodically expanded infrastructure, enhanced purification methods, and secured stable supply lines. Its evolution mirrored California’s own growth—transforming arid landscapes and supporting booming populations. Through economic cycles, wars, and regulatory changes, AWR adhered to a foundational principle: water is indispensable, and supplying it responsibly is both a moral duty and a sound business strategy. Rudimentary pipes, manual pumps, and visionary engineers who recognized that tapping into underground aquifers could shape communities’ destinies. Each improved filter or extended pipeline was more than a technical feat—it was an investment in public health and prosperity. As you invest in AWR, you link your financial future to a legacy forged by pioneers who understood that the surest bet in an unpredictable world is providing what people cannot live without.

Cultural and Ethical Values

AWR’s culture rests on stewardship, accountability, and service. It must not only meet stringent regulatory standards but also anticipate future water needs. Ethical conduct at every level—customer billing, safety protocols, environmental compliance—reinforces trust. The company regards its role as that of a caretaker: ensuring that communities have consistent, high-quality water, and maintaining infrastructure that endures for generations, all while delivering returns to shareholders who appreciate a stable, principled approach. Imagine standing at the edge of a reservoir at dawn, the water surface reflecting the sky’s first light. AWR’s employees carry this sense of reverence into their daily work, understanding that each drop counts. As an investor, your dividends come not from financial trickery or short-term gambles, but from a moral commitment to providing a resource as timeless as it is essential.

Leadership Philosophy and Style

AWR’s leadership embraces long-term planning over short-lived gains. They coordinate with regulators, maintain prudent capital structures, and invest in infrastructure upgrades that might bear fruit decades later. Communication with stakeholders—customers, investors, communities—is transparent, fostering a stable environment where dividend growth is no accident but the natural result of thoughtful governance and foresight. Picture a board meeting without the frantic chase for quick profits. Instead, imagine calm discussions about aquifer levels, drought contingency plans, and long-range demand projections. Leaders focus on slow, steady improvements rather than market stunts. Each incremental decision adds to a robust foundation that eventually manifests in your quarterly dividend, a quiet nod from a management team that values resilience over razzle-dazzle.

Innovation and Adaptability

While water’s elemental importance endures, delivering it effectively requires ongoing innovation. AWR invests in advanced filtration, leak detection sensors, and efficient water recycling methods. It adapts to climate variability—installing infrastructure that can handle droughts or floods—and leverages data analytics to predict maintenance needs. By evolving steadily, AWR ensures its operations remain both environmentally responsible and financially robust, feeding into the stable cash flows that underwrite its legendary dividend streak. Visualize technicians using remote sensors to identify pipe weaknesses long before a break occurs, or engineers modeling future water demand to guide expansion. These subtle, behind-the-scenes improvements ensure the system remains reliable. Your dividends arise from this quiet dedication to perfection—evidence that innovation, while rarely flashy in utility services, is essential for upholding the promise of consistent returns.

Strategic Decision-Making

AWR’s strategic moves center on strengthening supply reliability, managing costs, and meeting regulatory benchmarks. The company balances the need for infrastructure investment with rate structures that remain fair to customers. Expansion into new service areas or utilities is measured, ensuring that core competencies—delivering clean water—aren’t compromised. This patient, methodical strategy ensures earnings remain steady, forming the bedrock for dividend growth that outlasts economic swings. Imagine a gardener pruning a centuries-old bonsai tree, shaping each branch gently and deliberately. AWR’s strategic planning resembles this art: careful, considered actions that respect the system’s natural growth patterns. Your dividends are like the blossoms of this well-tended tree—arriving season after season, not because of radical transformations, but due to precise, incremental nurturing.

Human Capital and Management

At AWR, skilled professionals—from hydrologists to infrastructure technicians—form the backbone of reliable service. The company invests in employee training and safety, ensuring that those who operate and maintain its extensive networks do so with confidence and expertise. By valuing its workforce, AWR maintains operational excellence, translating into fewer disruptions, stable revenues, and the kind of predictable earnings growth that supports 70 consecutive years of dividend increases. Picture a seasoned water technician who knows the terrain’s contours, the character of local soils, and how seasonal changes affect supply lines. This intimate knowledge, passed through generations of workers, ensures that service interruptions remain rare. Your dividends arise from these human connections, the quiet handshakes and problem-solving sessions that ensure water continues to flow smoothly into customers’ homes—and, by extension, into your investment returns.

Market Position and Competitive Landscape

Water utilities, often operating as regulated monopolies in their territories, enjoy stable customer bases. While AWR must comply with regulatory constraints and environmental mandates, it faces limited direct competition. This relative insulation from market frenzy means revenues don’t see wild swings. Over decades, this stability has fueled one of the longest dividend growth streaks in history—a 70-year testament to enduring market positioning. Imagine a well-protected oasis in a desert of corporate competition. While other industries battle for market share, AWR’s role is secure: people will always need water, and few can provide it as reliably. For investors, this natural moat means dividends come with less drama. Like a perennial spring hidden in rocky hills, AWR’s earnings flow steadily, unaffected by passing storms of market speculation.

Risks and Mitigation Strategies

Even essential services face challenges. Drought, climate change, regulatory shifts, and infrastructure costs must be managed. AWR mitigates these risks by maintaining strong relationships with regulators, investing in long-term water resource planning, and safeguarding financial health. This preparedness, honed over decades, ensures that even when natural or administrative obstacles arise, the company’s dividend policy remains unharmed. Picture a sturdy levee holding back floodwaters. AWR’s risk management strategies function like that levee, preventing financial torrents from overwhelming its earnings. When you receive your dividend check, consider it evidence that the company can navigate rough waters without compromising its shareholders’ interests. In essence, it’s a promise that short-term turbulence won’t wash away long-term stability.

Additional Emphasis on the Science and First-Principles Perspective of Water

The Physics and Chemistry of Water’s Importance

From a first-principles standpoint, water (H2O) is fundamental to life as we know it. At the molecular level, water’s polar structure and hydrogen bonding capacity grant it unique properties: it dissolves essential nutrients, regulates temperature, and supports cellular processes that define living organisms. In physics, water’s high specific heat capacity moderates climates, while its fluid dynamics underpin ecosystems and agriculture. Without water, biochemical reactions that sustain life would grind to a halt. For humanity, securing a clean and steady supply of this extraordinary molecule is not an option—it’s a prerequisite for civilization itself. Against this scientific backdrop, AWR’s business model transcends typical corporate pursuits; it provides a substance so integral that it shapes biology, chemistry, and the very fabric of societal stability.

Imagine standing at the crossroads of thermodynamics and biochemistry, where water’s molecular dance orchestrates the symphony of life. Your investment in AWR aligns with this elemental truth: as long as humans exist, we must harness the miracle of H2O. Each dividend payment stands as a quiet affirmation that you own a share in a process older than profit motives, a cycle where molecules and meaning merge. Over 70 years of dividend growth is no coincidence—it’s rooted in the undeniable physics that no technology, currency, or commodity can outvalue the essential nature of water.

Part 2: Dividend Philosophy and Sustainability

Dividend Tradition and Philosophy

AWR’s over 70 consecutive years of increasing dividends sets an almost mythic benchmark. This legacy arises from a philosophy that stable, incremental growth in shareholder returns isn’t a perk—it’s the company’s defining promise. While other companies struggle to maintain a decade of dividend hikes, AWR’s multi-generational payout tradition serves as proof that providing life’s most fundamental resource can sustain not only societies but also steady wealth accumulation. Picture a river carving its path through a valley for millennia, gently deepening its channel and widening its reach. AWR’s dividend growth follows a similar natural rhythm: incremental changes that accumulate into something monumental. With each rising payment, you join a lineage of investors who chose patience and principle, reaping financial nourishment from a source as dependable as sunlight and rainfall.

Dividend Consistency and Culture

Consistency at AWR isn’t an accidental byproduct—it’s woven into the corporate culture. Each infrastructure improvement, each regulatory compliance act, and every strategic move aims to strengthen the company’s earnings base. Over time, this disciplined approach has created a pattern of dividend increases so well-established it’s part of the company’s identity. For shareholders, it’s a powerful assurance that the next quarter’s check will likely be a bit higher than the last. Envision a gardener carefully watering a fruit orchard every year, ensuring steady growth and harvests that never fail. AWR’s dividend culture resembles this gardener’s devotion: it’s a cycle nurtured over decades. Your dividends, too, arrive as a sweet, predictable harvest, cultivated by those who see value in steady hands and timeless essentials rather than fleeting opportunities.

Impact of Strategic Decisions on Dividends

Every step AWR takes—upgrading a filtration system, securing a new water source, meeting new environmental standards—ultimately shapes its earnings trajectory. Over long periods, these careful enhancements accumulate, enabling the company to boost dividends year after year. Thus, dividends serve as a direct scorecard of management’s capability to steward resources and maintain financial health amidst shifting conditions.

Additional Narrative:

Imagine each capital improvement as a subtle strengthening of a dam, raising the reservoir’s water level bit by bit. Eventually, the reservoir can support a higher outflow—your dividends. These incremental refinements, chosen with foresight and restraint, ensure that growth in shareholder payouts is organic, stable, and proportionate to the company’s solid foundation.

Stakeholder Value Creation

AWR’s model ensures value flows symbiotically: customers gain reliable water services, employees find stable careers, communities receive environmental stewardship, regulators trust the company’s compliance, and shareholders earn dividends. This balanced ecosystem thrives because it respects all participants. The result: a structure resilient enough to endure economic upheavals and changing norms, continuing to deliver dividends through it all.

Additional Narrative:

Picture a community garden where everyone contributes labor, seeds, and care, and all benefit from the harvest. AWR’s approach to stakeholders resembles this cooperative spirit. Each dividend payment you receive is like a portion of that communal bounty—a product of shared responsibility and mutual gains, upheld by a corporate vision that doesn’t pit one stakeholder’s interests against another’s.

Financial Prudence and Allocation

AWR’s disciplined capital allocation ensures adequate reinvestment, maintains healthy leverage, and secures dividends well into the future. By not stretching itself thin with high-risk ventures or aggressive M&A, the company avoids pitfalls that erode shareholder value. This prudence underpins a dividend record that speaks for itself, making AWR a refuge for income-seeking investors who value consistency over excitement.

Additional Narrative:

Imagine a steady hand distributing resources justly: repairing old pipes before building new ones, balancing rate increases with efficiency gains, and saving for a rainy day (or dry season). Your dividend emerges from this careful equilibrium, the assurance that no reckless gamble will jeopardize what took generations to build. It’s a calm oasis in a corporate landscape often marred by speculative frenzy.

Economic Moats and Dividend Safety

AWR’s regulated monopoly in its service territories and the undeniable necessity of water form a robust economic moat. While subject to oversight and cost controls, the company’s essential nature wards off revenue volatility. This fortress-like position ensures that even as industries rise and fall, AWR’s earnings endure, allowing dividends to keep climbing one modest step at a time.

Additional Narrative:

Picture an ancient well in a village: no other source can replace it, and the people care for it diligently. AWR’s moat resembles that well, safeguarded by necessity and trust. Your dividends reflect this stability, a trickle that never dries up, sustained by customers who need water as surely as they need air.

Corporate Governance and Dividend Policy

Strong governance ensures dividends aren’t illusions conjured by accounting acrobatics. Transparent reporting, clear communication, and a long-tenured management ethos underscore the authenticity of AWR’s dividend policy. Instead of temporary yield spikes, shareholders enjoy a reliable, upward trend rooted in honest operations and careful planning.

Additional Narrative:

Imagine a council of wise elders who pass down meticulous records and standards to each new generation. AWR’s board and executives adopt this stance, valuing legacy as much as innovation. Each dividend increase isn’t a random act of generosity—it’s a deliberate reaffirmation that the company’s principles and methods remain aligned with shareholder interests.

Long-Term Vision and Dividend Growth

AWR’s vision extends decades into the future, considering population growth, climate factors, and regulatory evolutions. By planning infrastructure upgrades and resource management accordingly, the company ensures that dividends can continue their subtle, unbroken ascent. This forward focus means that the dividend growth streak not only stands as a remarkable historical achievement but also as an ongoing narrative of confidence in tomorrow.

Additional Narrative:

Envision a forest planted for future generations, where saplings chosen today shape the canopy of centuries to come. AWR’s strategy, similarly, is about planting seeds of stability and growth that will pay off long after current management and shareholders have moved on. When your dividend rises again, it’s a gentle whisper that the forest is thriving, and will likely keep doing so for years ahead.

Qualitative Insights and Future Outlook

Behind the metrics lies a simple truth: water is irreplaceable. As societies grow, adapt, and overcome challenges, the need for clean, accessible water remains constant. AWR’s unparalleled dividend history proves that when a company respects the elemental importance of its product and plans diligently, it can transcend fads and crises. The future likely holds more of the same: steady improvements, cautious expansions, and dividends that steadily climb, drop by drop, into your account.

Additional Narrative:

Imagine standing beside a mountain spring—a timeless source of life and refreshment. You can draw from it today, and your grandchildren can do the same decades hence. That’s the essence of AWR’s outlook and why its dividends command such reverence. By tapping into something primal, something scientifically and ethically indisputable, AWR ensures that financial growth, like water flow, will persist as long as humans remain bound to the physical laws that make water essential.

Conclusion

Synthesis and Strategic Insights

American States Water Company’s 70-year streak of increasing dividends is no accident—it’s the logical outcome of providing an irreplaceable resource through disciplined management, ethical stewardship, and forward-looking strategy. By grounding its business in the fundamental laws of nature—where H2O underpins life itself—AWR transcends the volatility of markets and the transience of consumer trends. For dividend investors, this is an investment in something both ancient and modern: the knowledge that as long as humans need water, a well-run utility like AWR can continue to reward patience and principle with steadily rising dividends.

Additional Narrative:

Reflect on your position in a chain of events spanning generations. Each dividend check connects you not just to corporate decisions and spreadsheets, but to a deeper reality: water’s immutable importance. AWR’s record of payout increases is more than a financial statistic; it’s a celebration of the physics and chemistry that make life possible, and a promise that, for investors who trust in nature’s elemental truths, stability and growth can flow as endlessly as a springtime creek.

Warm regards,

Zachary Gedal

Share this:

Like this:

Loading…

Tags: Dividend Reviews, Dividends, American States Water, AWR, Utilities, Water Necessity

Previous: D.18 | A Deep Dive into The York Water Company (YORW)

Next: Portfolio Update #3 [Jul ‘24]

Instagram / TikTok / X

Designed with WordPress