DP.16| Dividend Portfolio Update #16 – August 2025

I. July 2025 Market & Dividend Landscape: Resilience Amid a Mid-Year Calm

AI-Driven Rally Persists Amid Economic Headwinds: Markets Reach New Peaks, Tariff Effects Emerge

August 2025 Dividend & Market Analysis

The first half of August 2025 has propelled major indices to fresh records, with the S&P 500 closing at 6,445.76, up approximately 1.1% on August 12, and the Nasdaq at 21,681.90, advancing 1.4% on the same day. This surge reflects continued AI enthusiasm and positive inflation readings, though core CPI ticked up to 3.1% year-over-year in July, while overall inflation held at 2.7%. Investors are increasingly betting on Federal Reserve rate cuts starting in September, with markets anticipating three reductions by year-end to ease borrowing costs amid cooling labor trends and emerging tariff pressures from the Trump administration.

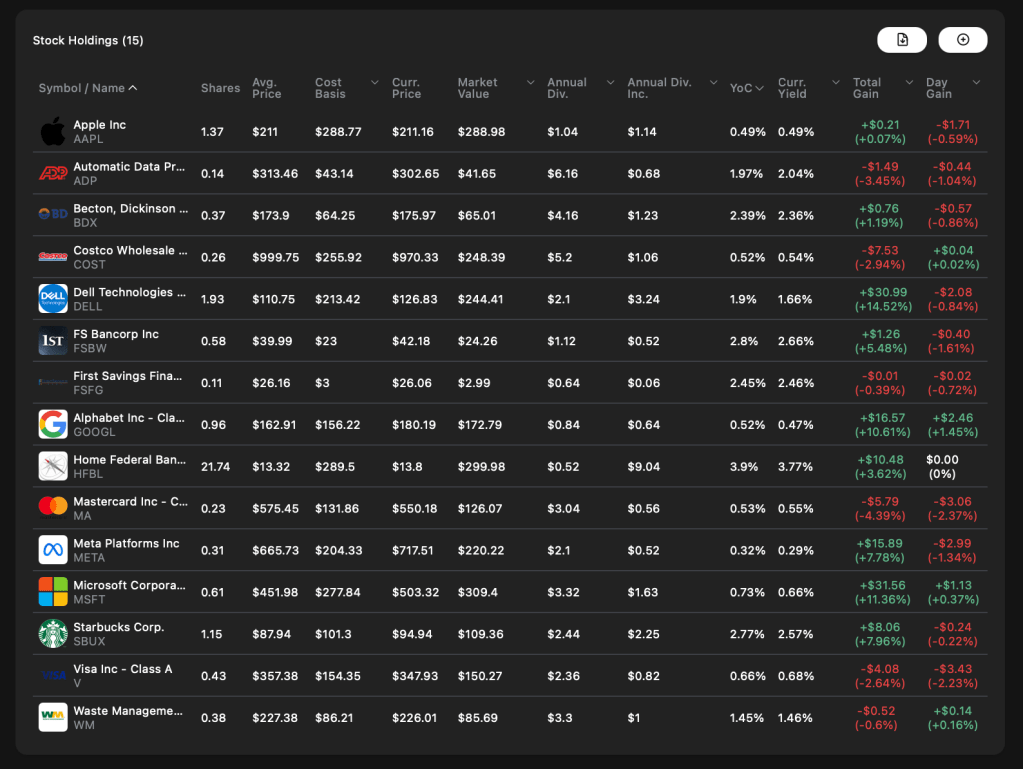

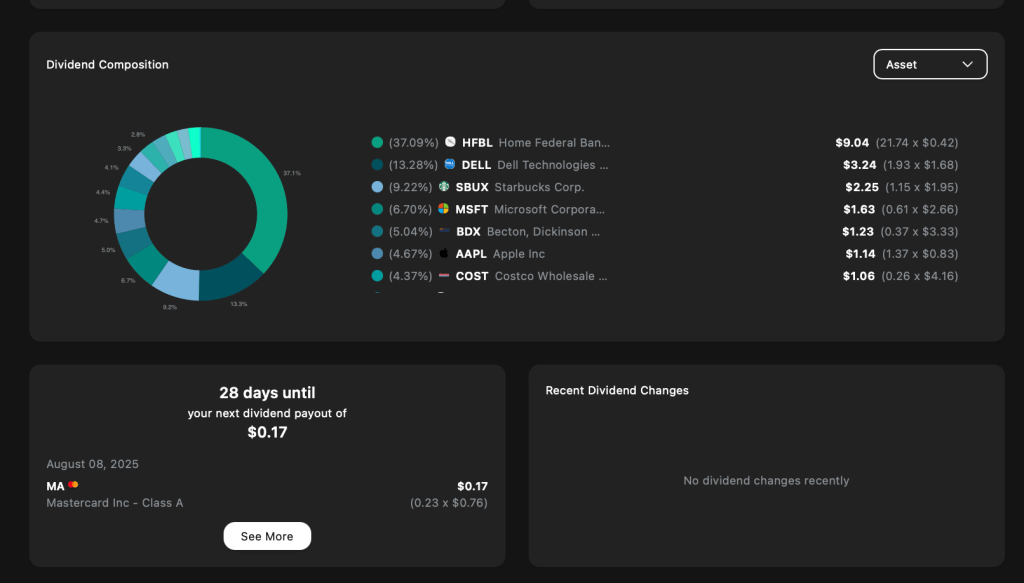

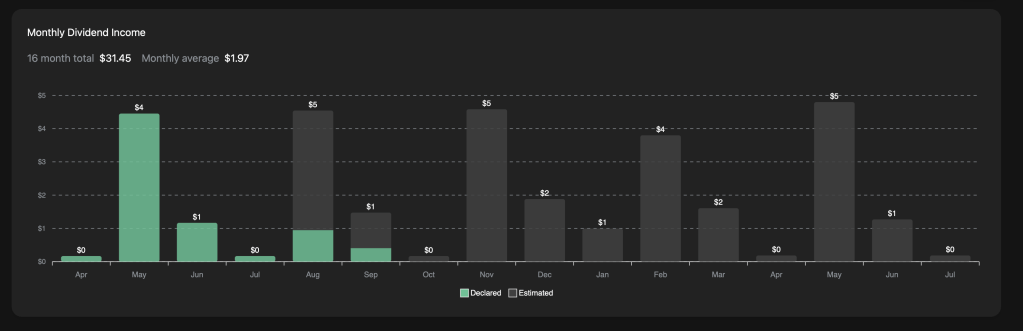

This landscape paints a resilient market split: tech giants powering gains through AI investments, while broader sectors face mixed signals from stubborn inflation and consumer caution. For dividend investors, leveraging tools like DivTracker for real-time tracking is invaluable—our portfolio shows an annual dividend income of $29.59, with a 1.04% yield and key contributions from holdings like HFBL (34.09%) and DELL (11.95%). This month, we focus on quality assets that balance growth and income stability.

The AI Super-Cycle Maintains Momentum

Technology leads the charge, with the sector up over 30% year-to-date, outpacing the market amid robust AI demand. Our tech positions are well-placed in this trend. Dell Technologies (DELL) solidified its AI infrastructure role in Q1 FY2026 (ended May 2025), posting revenue of $23.4 billion, up 5% year-over-year, with record shareholder returns of $2.4 billion via dividends and buybacks. AI servers continue to drive enterprise growth, countering PC market softness.

Post-July earnings from peers affirmed the cycle’s strength:

Microsoft (MSFT) reported Q4 FY2025 revenue of $281.7 billion (full fiscal year), up 15%, with Azure cloud services exceeding $75 billion, up 34%. Alphabet (GOOGL) delivered Q2 revenue of $96.4 billion, up 14% (13% constant currency), fueled by Cloud and AI despite regulatory scrutiny. Apple (AAPL) achieved Q3 revenue of $94 billion, up 10%, with iPhone up 13% and services at a record $27.4 billion (wait, but in results $94B total, profit $23.4B). Meta (META) posted Q2 revenue of $47.52 billion, up 22%, with EPS at $7.14, driven by ads and AI.

Financials and Dividends: Steady Income Amid Rate Shifts

Our financial anchors provide reliable payouts, enhanced by recent increases and the prospect of Fed easing. FS Bancorp (FSBW) reported Q2 net income of $7.7 million ($0.99 per share), with deposits at $2.55 billion, and declared its 50th consecutive quarterly dividend at $0.50 per share, up from $0.28. Home Federal Bancorp of Louisiana (HFBL) raised its quarterly dividend to $0.135 per share for the 12th consecutive year, yielding a forward annual of $0.54, supported by its stable community banking model. Recent changes via DivTracker highlight AWR’s quarterly hike to $0.50 (annual $2.00 FWD), declared July 31.

Key Capital Return Dates to Watch

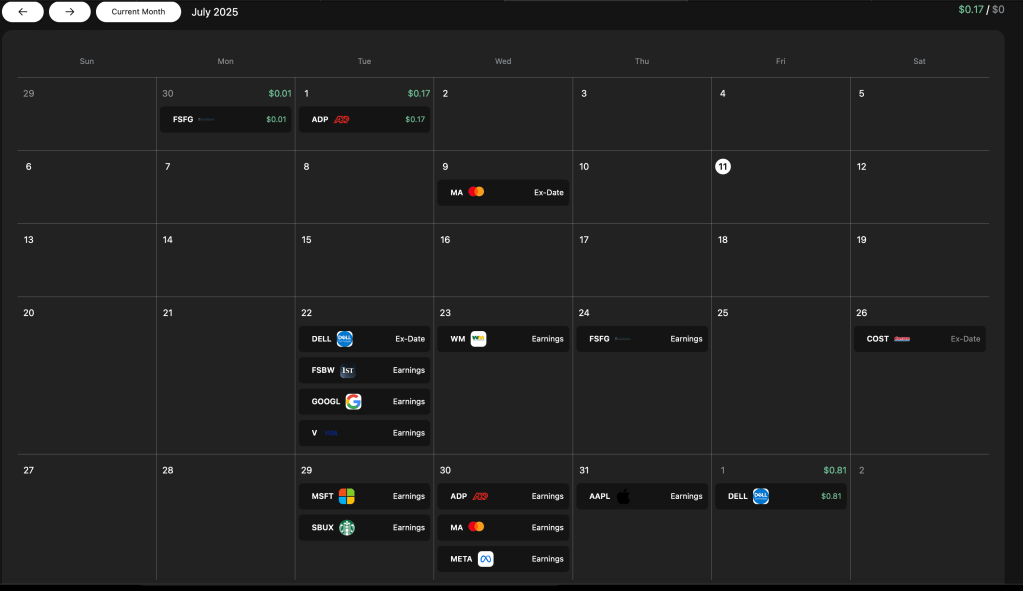

Monitoring via DivTracker’s calendar, notable events include: Apple (AAPL) paid $0.26 quarterly on August 14 (ex-date August 11). Home Federal Bancorp (HFBL) paid $0.14 on August 18 (ex-date August 4). FS Bancorp (FSBW) payable August 21 (ex-date August 7) at $0.50. Microsoft (MSFT) ex-date August 21 for $0.83, payable September 11. Upcoming: Visa (V) ex-date September 12 for $0.59; Alphabet (GOOGL) ex-date September 8 for $0.21. Newer payers like Meta (META) and Costco (COST) signal maturing capital strategies.

Outlook: Balanced Approach in a Greedy Market

As we advance through 2025, our strategy integrates AI growth with defensive dividends, tracked closely via DivTracker showing monthly average income of $2.54 toward our goals. The CNN Fear & Greed Index at around 58 indicates “Greed,” suggesting optimism but vulnerability to corrections from tariffs or data shifts. Pivotal factors: AI durability, earnings resilience, consumer trends, and Fed actions. Prioritizing strong fundamentals ensures long-term compounding of growth and income.