September 2025 Dividend Portfolio Update

I. September 2025 Market & Dividend Landscape: Resilience Amid a Mid-Year Calm

September Market Outlook: AI Propels Growth, Dividends Provide Stability

As September unfolds, the financial markets are demonstrating remarkable resilience and growth. The S&P 500 and Nasdaq are consistently reaching new highs, largely fueled by the relentless innovation in artificial intelligence and a more encouraging economic landscape. The prevailing sentiment among investors points towards a potential interest rate cut by the Federal Reserve in the near future, possibly as early as this month. Such a move would mark the first in a series of anticipated reductions, designed to provide further impetus to economic expansion.The AI Revolution: A Driving Force in Tech and Beyond

The technology sector remains at the forefront of this market surge, with AI investments acting as a significant catalyst. While other sectors grapple with inflationary pressures and evolving regulatory frameworks, AI-driven companies are experiencing unparalleled growth. The impressive performance of tech stocks, up over 35% this year, underscores the immense demand for AI technologies.

Dell Technologies, for instance, reported an exceptional quarter, with a 19% increase in revenue attributed to robust shipments of AI servers. This trend extends across major tech giants like Microsoft, Google, Apple, and Meta, all of whom are realizing substantial gains from their strategic AI integrations. Even burgeoning startups are witnessing a remarkable 34% surge in revenue from their AI-powered tools. The pervasive influence of AI is now evident across diverse domains, including education, wellness, and productivity, reshaping industries and creating new opportunities.Dividend Investing: A Foundation of Stability with DivTracker

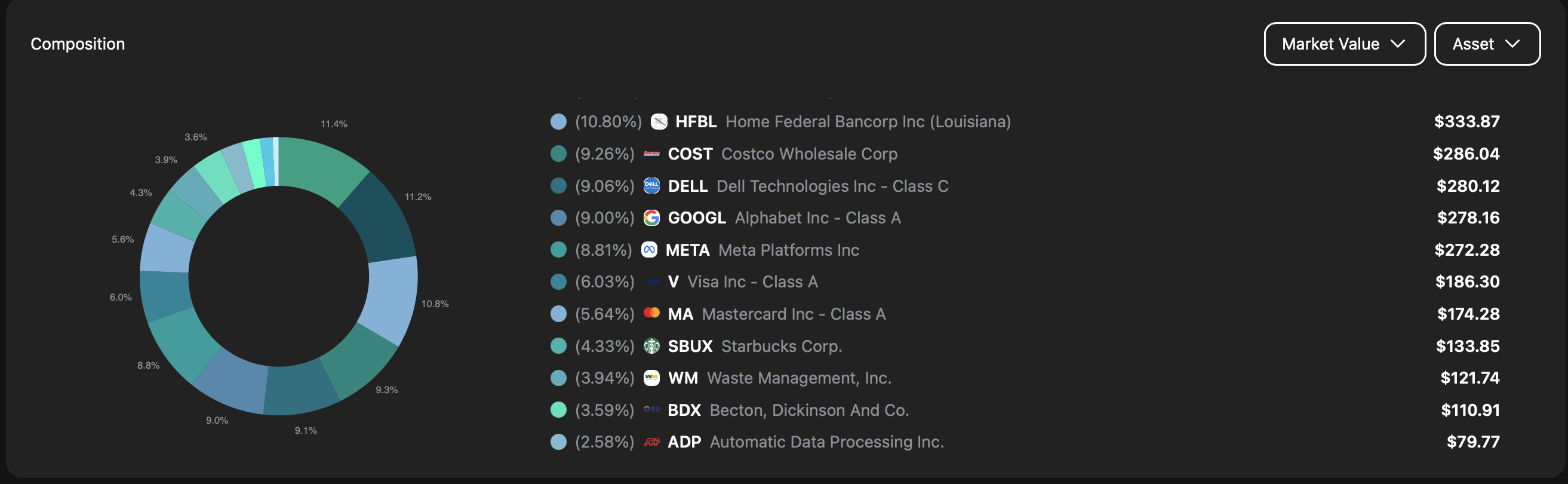

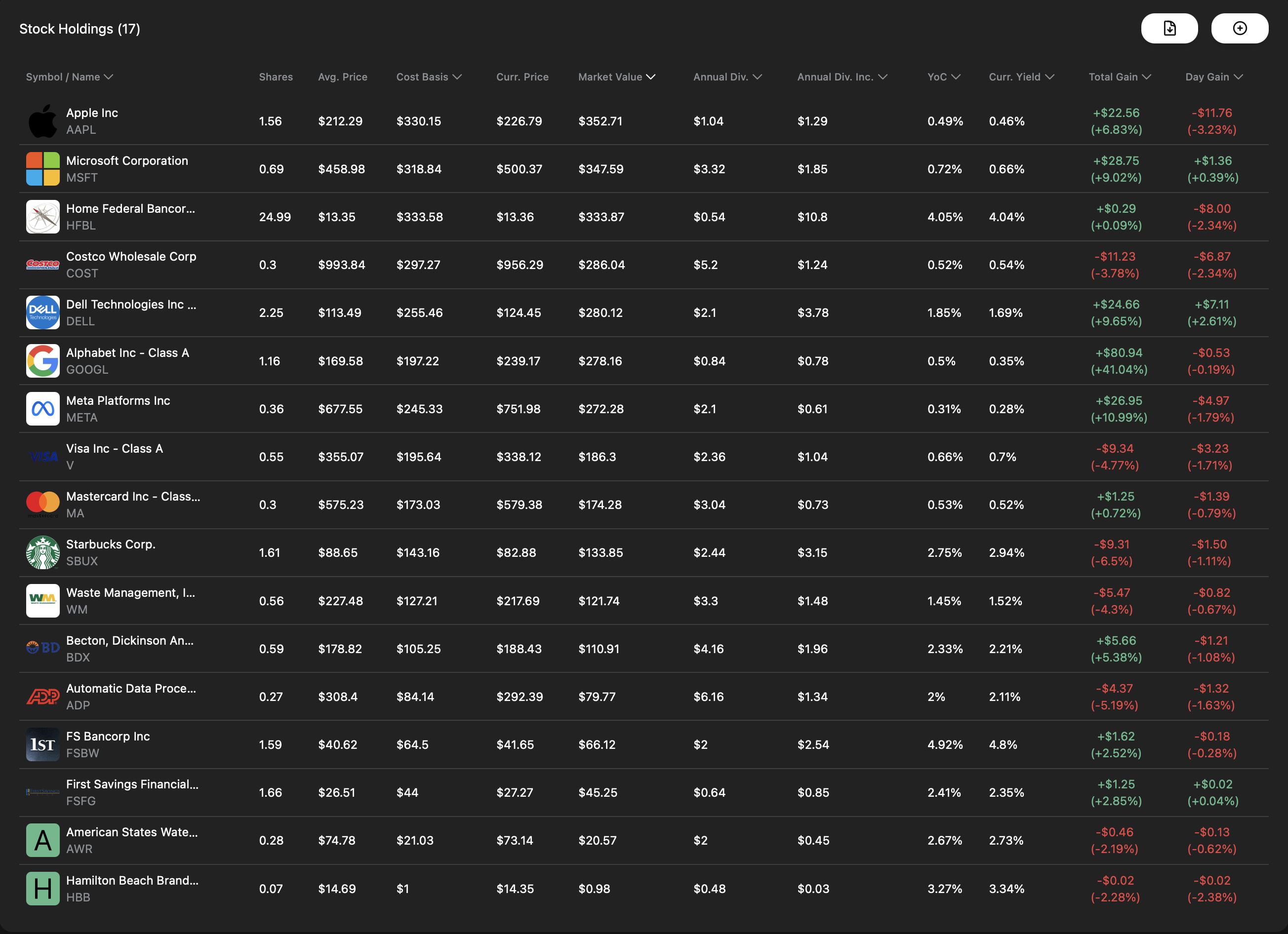

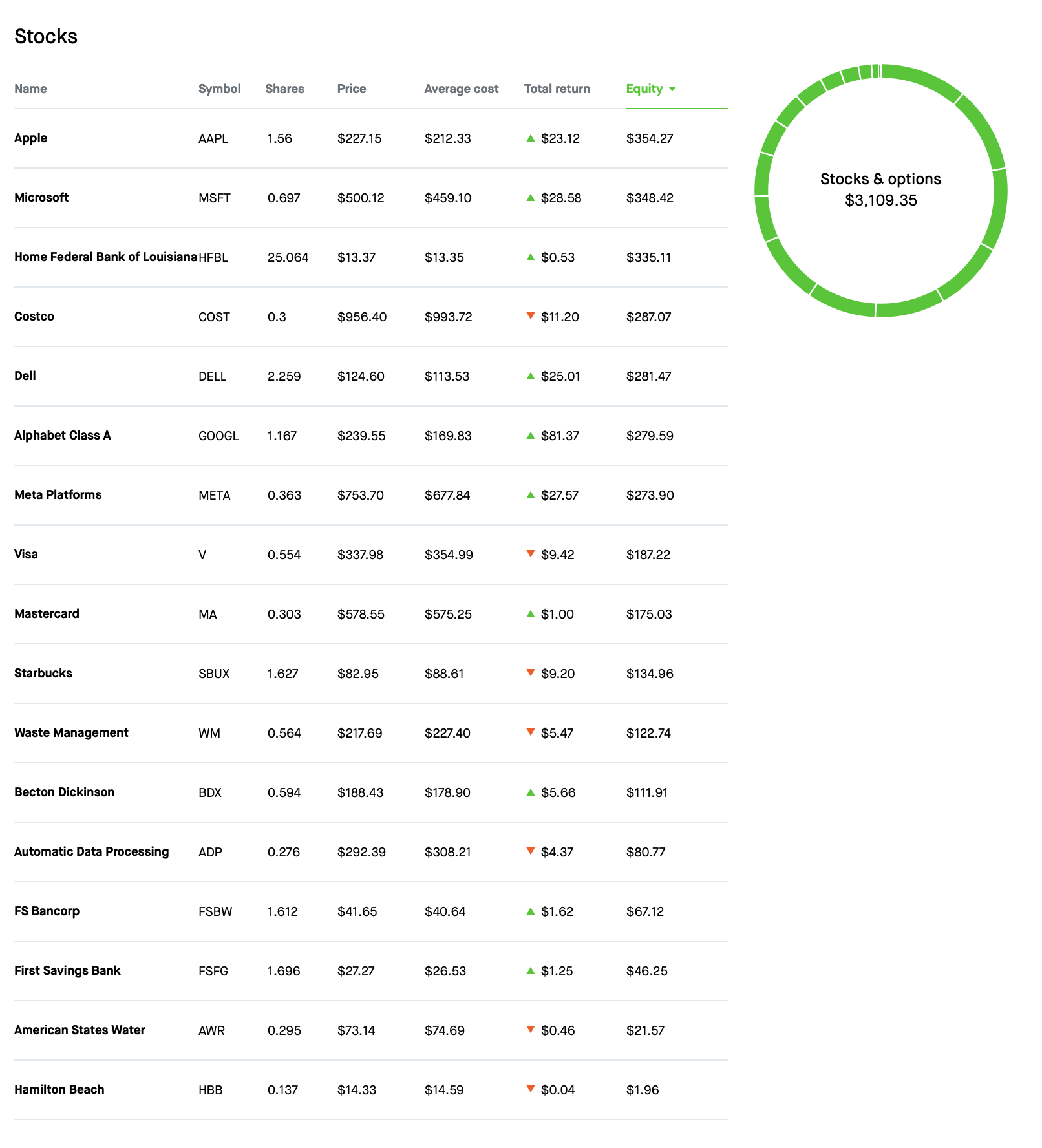

For dedicated dividend investors, the current market environment offers a compelling blend of growth and consistent income. Tools such as DivTracker prove invaluable in navigating this landscape, helping to monitor and optimize portfolio performance. Our current portfolio yields a solid $33.92 annually, with significant contributions from key holdings like HFBL and DELL. Our strategic focus for the month is on identifying robust companies that adeptly combine the explosive growth potential of tech with a proven track record of reliable dividend payouts.

Our financial holdings are also playing a crucial role in providing steady income, particularly as the Federal Reserve contemplates easing its monetary policy. Companies such as FS Bancorp and Home Federal Bancorp of Louisiana continue to maintain their consistent dividend distributions. American States Water recently announced an impressive 8.3% increase in its dividend, further reinforcing the stability of our portfolio. DivTracker provides real-time insights into these positive adjustments, ensuring our investments remain resilient and well-positioned.

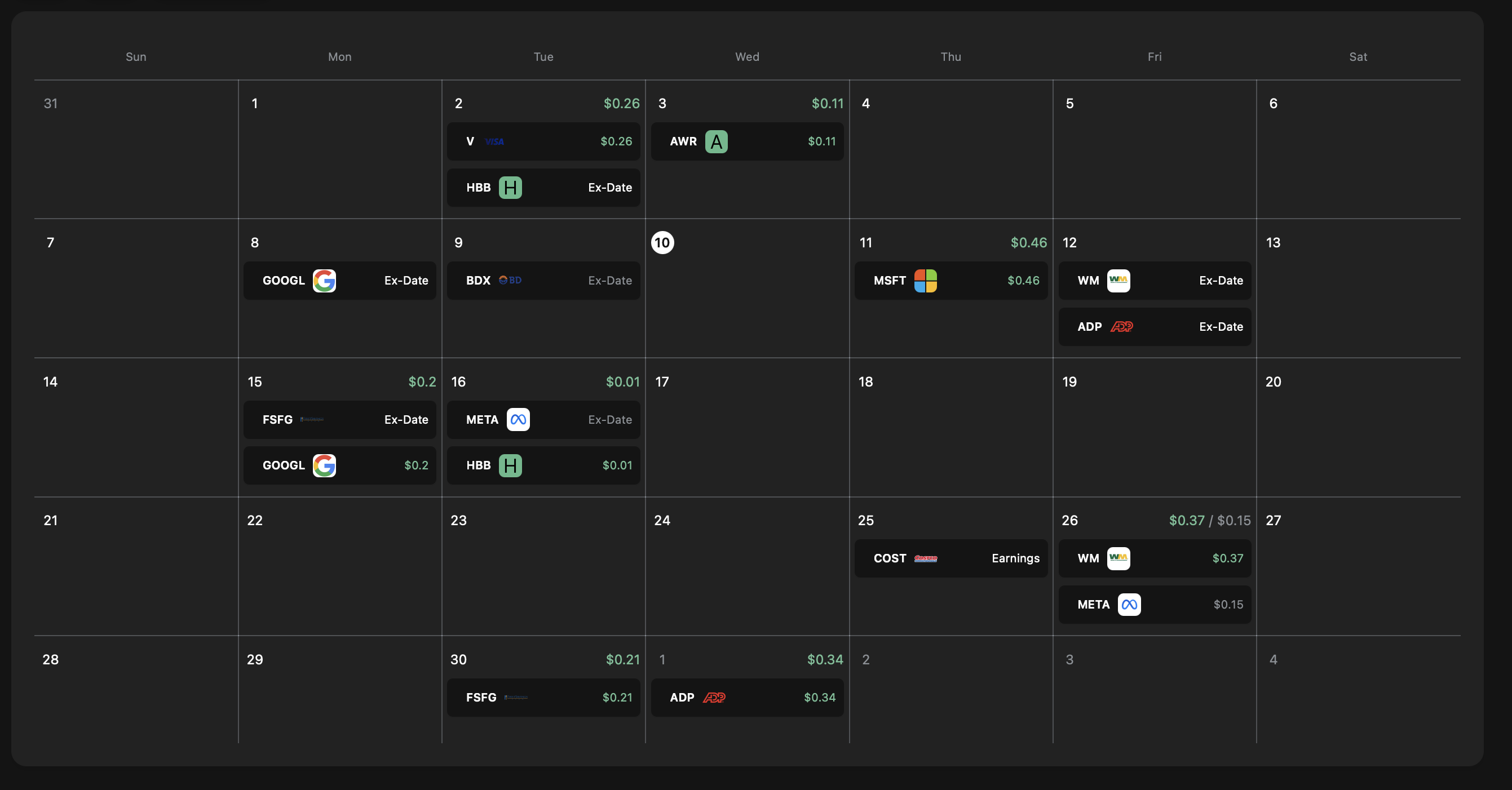

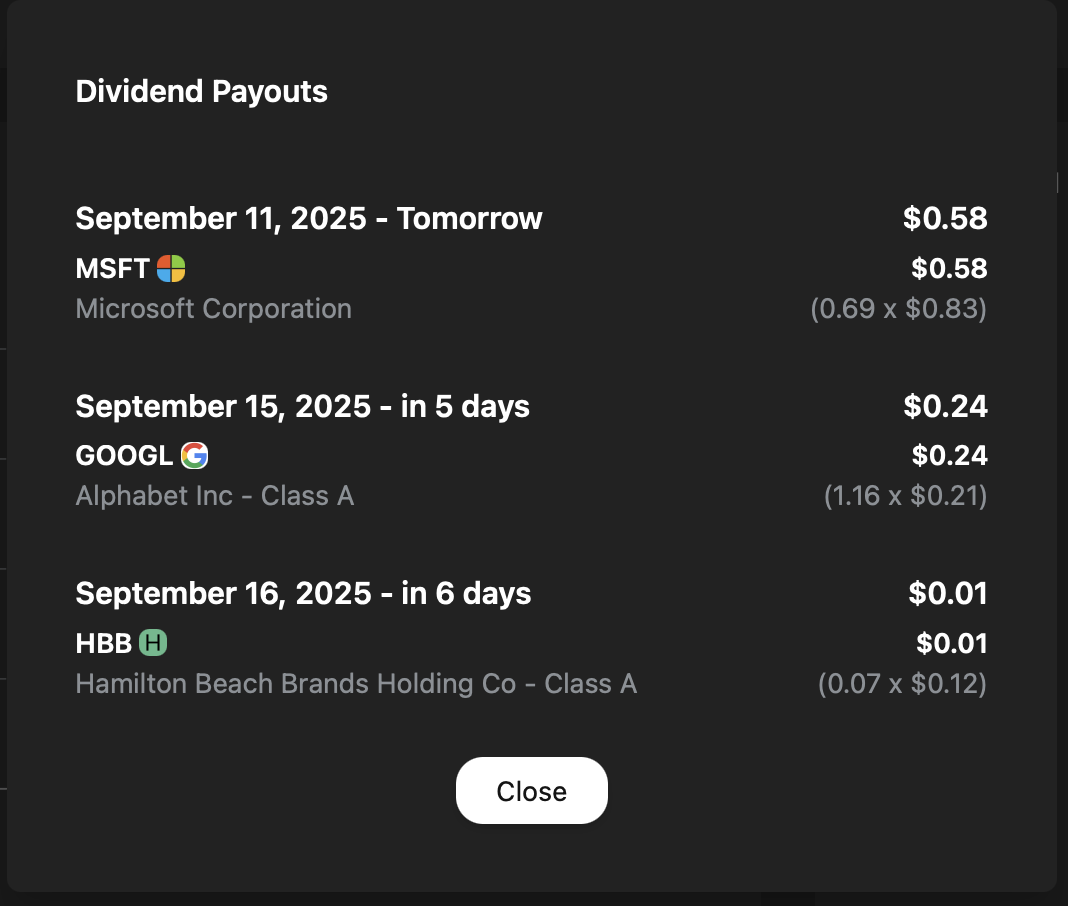

DivTracker’s utility extends beyond portfolio monitoring, offering crucial visibility into upcoming dividend payment dates. Microsoft, Google, Visa, and Meta are all scheduled for payouts in the near future. Additionally, Apple and Costco are on our radar for October, showcasing how even high-growth companies are strategically managing their dividend policies.Strategic Outlook: Balancing Growth and Income

Looking ahead, our investment strategy remains firmly rooted in a balanced approach, seamlessly integrating AI-driven growth with reliable dividend income. We are consistently meeting our monthly income targets, and the market currently exhibits a neutral sentiment, as indicated by the CNN Fear & Greed Index.

Despite the positive momentum, we remain vigilant, closely monitoring inflation data and any unexpected policy shifts from the Federal Reserve. The cornerstone of our strategy lies in focusing on strong company fundamentals, a principle that ensures both growth and dividends continue to compound effectively over the long term, ultimately contributing to sustained portfolio expansion.

The first half of September 2025 has been marked by a significant rally in major indices, underscoring persistent optimism surrounding artificial intelligence (AI) and the anticipation of forthcoming Federal Reserve rate cuts. On September 9, the S&P 500 closed at approximately 6,512.61, registering a daily gain of about 0.27%, while the Nasdaq surged to 21,879.49, up 0.37%. This upward trend is occurring despite economists’ projections for the August Consumer Price Index (CPI) to rise to 2.9% year-over-year, an increase from July’s 2.7%. The CPI report, due September 11, is a critical data point that markets are closely watching.

Market participants are largely pricing in a Federal Reserve rate cut at the upcoming September 16-17 meeting. This potential move would be the first in a series of anticipated rate reductions by year-end, aimed at supporting economic growth amidst moderating inflation and a cooling labor market. This dynamic environment highlights a tech-led market, where substantial AI investments are driving significant gains. In contrast, other sectors are navigating challenges such as higher wholesale prices and policy uncertainties. For dividend investors, specialized tools like DivTracker remain indispensable for real-time monitoring of portfolio performance. Our current portfolio reflects an annual dividend income of $33.92, yielding 1.09%, with substantial contributions from key holdings such as HFBL (30%) and DELL (12%). This month, our investment strategy continues to prioritize resilient assets that effectively blend technological growth with reliable income streams.

The AI Super-Cycle Accelerates: Strategic Tech Positioning

The technology sector maintains its dominant position, having surged over 35% year-to-date, primarily fueled by the escalating demand for AI infrastructure. Our strategic tech exposures are precisely positioned to capitalize on this trend. Dell Technologies (DELL) delivered an exceptionally strong Q2 FY2026, which concluded in August 2025. The company reported record revenue of $29.8 billion, marking a remarkable 19% year-over-year increase, largely driven by robust AI server shipments. Dell’s operating income also saw a significant boost, rising 27% to $1.8 billion. These impressive results stand in stark contrast to the broader market’s softer performance, unequivocally reinforcing Dell’s leadership in the AI domain.

Recent updates from prominent industry peers further sustain this accelerating trend. Microsoft (MSFT) continues to build on the momentum from its strong FY2025 results, with Azure cloud growth specifically highlighting the widespread adoption of AI in cloud computing. Similarly, Alphabet (GOOGL), Apple (AAPL), and Meta (META) are significantly benefiting from deeper AI integrations across their core products and services, including search, devices, and advertising. Furthermore, the broader impact of AI is evident in the startup ecosystem, where companies leveraging AI tools are reporting an average revenue growth of 34%. Overall, AI trends in September indicate a pervasive increase in adoption across diverse sectors, including education, wellness, and productivity, signaling an ever-deeper economic integration of artificial intelligence.

Financials and Dividends: Reliable Payouts in a Shifting Rate Landscape

Our financial holdings consistently deliver stable income, a performance significantly bolstered by recent dividend hikes and the impending easing of monetary policy by the Federal Reserve. FS Bancorp (FSBW) has maintained an impressive streak, announcing its 50th consecutive quarterly dividend of $0.50 per share, which was payable on August 21 (ex-date August 7), following a solid Q2 net income of $7.7 million. Home Federal Bancorp of Louisiana (HFBL) continued its remarkable record by maintaining its $0.135 quarterly dividend for the 12th consecutive year of increases, with the payment made on August 18 (ex-date August 4). American States Water (AWR) further enhanced our portfolio’s income stream by announcing an 8.3% quarterly increase to $0.504 per share, payable on September 3 (ex-date August 15). These consistent adjustments and increases in dividend payouts, meticulously tracked via DivTracker, significantly enhance our portfolio’s overall stability and income generation capabilities.

Key Capital Return Dates to Watch: Maximizing Income Opportunities

Leveraging DivTracker’s comprehensive calendar functionality, we identify several critical capital return dates for investors to monitor closely. Microsoft (MSFT) had a dividend payable on September 11 (ex-date August 21) at $0.83 per share. Alphabet (GOOGL) had an ex-date of September 8 for a dividend of $0.21. Visa (V) has an upcoming ex-date of September 12 for a dividend of $0.59. Meta (META) has an ex-date of September 15 for $0.525. Looking ahead to October, Apple (AAPL) has an ex-date of November 10 for $0.26, and companies like Costco (COST) are reflecting evolving payout strategies among growth-oriented stocks. These upcoming dividend payments, tracked effectively through DivTracker, provide valuable insights for maximizing income opportunities and managing portfolio cash flow.

Outlook: Prudent Positioning in a Neutral Market

As 2025 progresses, our investment approach remains strategically balanced, merging the significant upside potential driven by AI innovations with the defensive stability provided by reliable dividend-paying stocks. DivTracker currently indicates a monthly average income of $2.83, bringing us closer to our targeted income goals. The CNN Fear & Greed Index, hovering around 52, suggests a neutral market sentiment, indicating a balance between investor optimism and caution. However, this neutral stance does not negate potential risks stemming from unexpected inflation data releases or surprises from Federal Reserve policy announcements. Critical watchpoints for the remainder of the year include the sustainability of the AI super-cycle, the broader corporate earnings outlook, trends in consumer spending, and the trajectory of global monetary policy. By focusing on companies with robust fundamentals and maintaining a diversified portfolio, we aim to support the sustained compounding of both growth and dividends, navigating the evolving market landscape with prudence and foresight.